Half Trend Indicator with Arrows and Button

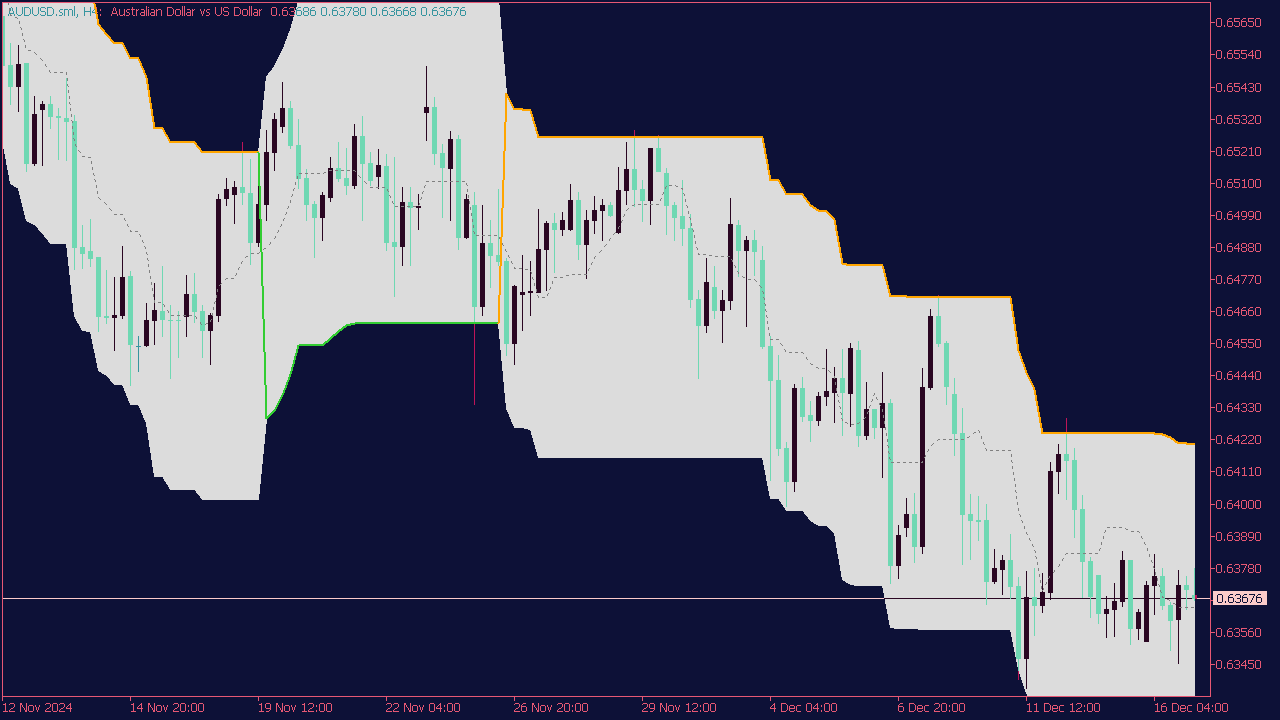

The SuperTrend Experiment Channel Indicator is a variation of the traditional SuperTrend indicator that combines trend detection with a channeling mechanism to visualize price movements more clearly. This indicator uses similar principles involving the average true range (ATR) to set the channel's boundaries, helping traders identify areas of potential support and resistance within the trend. By incorporating channels, the SuperTrend Experiment Channel Indicator aims to provide clearer signals for entry and exit points, making it easier for traders to visualize market conditions and adjust their strategies accordingly. It can be particularly useful in trending markets, offering insights into the strength and sustainability of price movements.

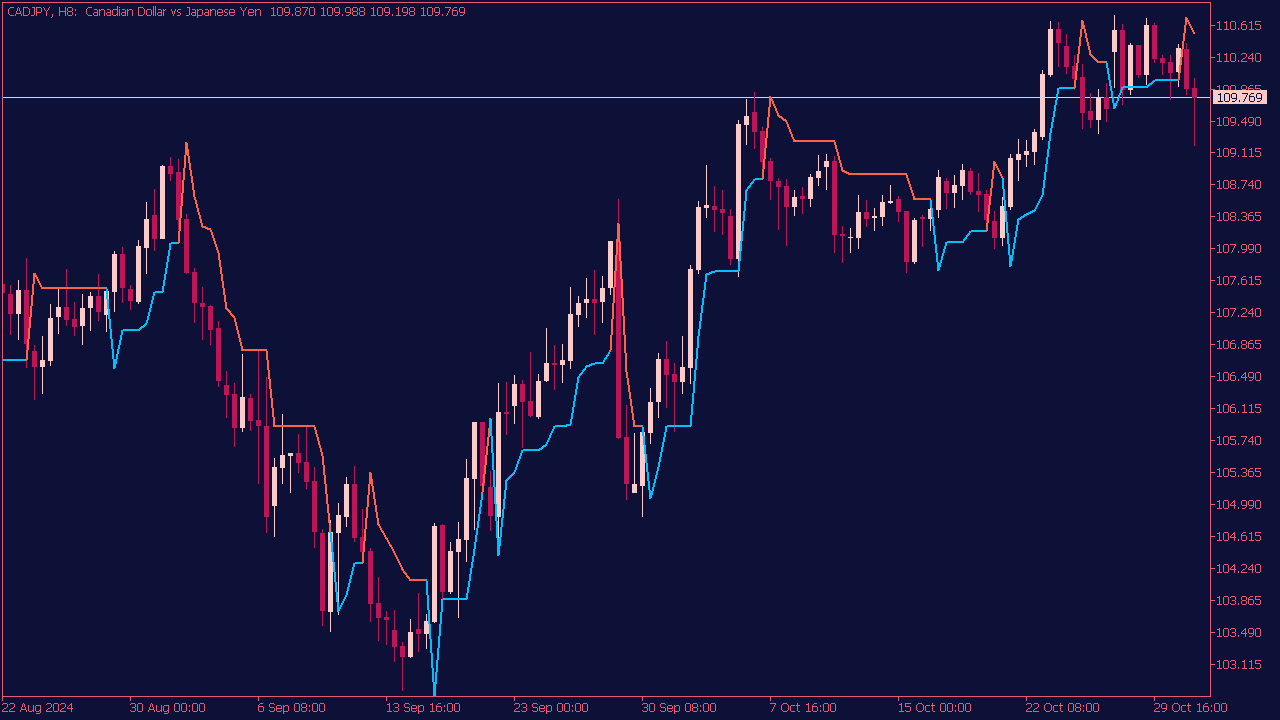

The Super Trend Averages Indicator is a trend-following tool that helps identify potential entry points in trading. When the indicator turns blue, it suggests taking a long position, indicating a bullish trend, while a red signal indicates a short entry, reflecting a bearish market. Traders often use additional confirmation from other indicators or price action to increase the reliability of these signals, ensuring they align with overall market conditions. For optimal results, consider using the Super Trend in conjunction with proper risk management and a defined trading strategy.

The Super Trend Indicator, a popular trading tool based on price action and volatility, helps traders identify potential buy and sell signals. A typical setup involves entering a long position when the price closes above the Super Trend line (indicating bullish momentum), with a stop-loss placed just below the Super Trend line. Conversely, a short position is initiated when the price closes below the Super Trend line, with a stop-loss above the line. Traders often combine this indicator with other tools, such as moving averages or RSI, to confirm signals and enhance accuracy in their trading strategies. Always consider market conditions and risk management practices in your trading approach.

The Super Trend Hull Indicator combines the Super Trend indicator, which identifies the market's trending direction, and the Hull Moving Average (HMA), known for its ability to minimize lag and enhance responsiveness. Buy signals are often generated when the price crosses above the Super Trend line, typically indicating a potential uptrend, while sell signals occur when the price falls below the Super Trend line, signaling a possible downtrend. Traders often confirm these signals with additional analysis or indicators to enhance decision-making and reduce false signals.

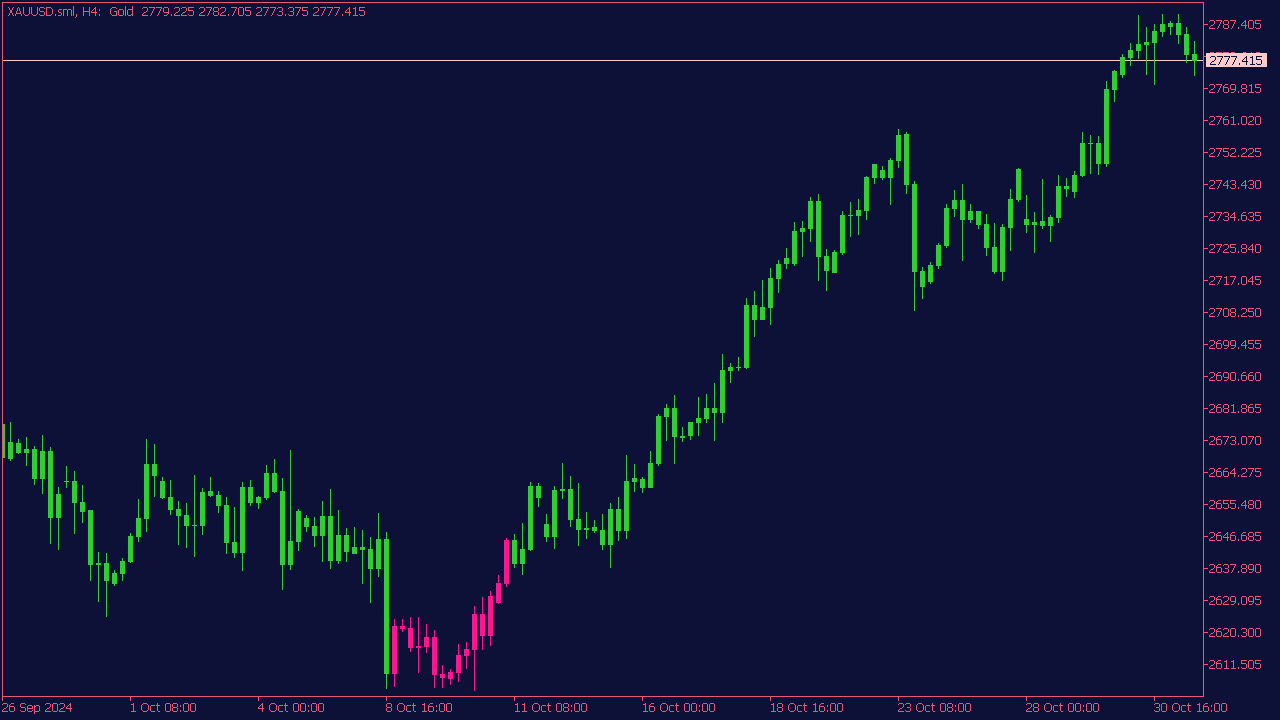

The Super Trend Extended Indicator is a popular tool used in trading to identify potential entry and exit points based on market trends. It generates buy and sell signals through colored candles, where typically a green candle indicates a bullish trend (buy signal) and a red candle indicates a bearish trend (sell signal). Traders often look for confirmation from other indicators or price action to minimize false signals. When using this indicator, consider incorporating risk management techniques and backtesting strategies to enhance accuracy and effectiveness in real market conditions.