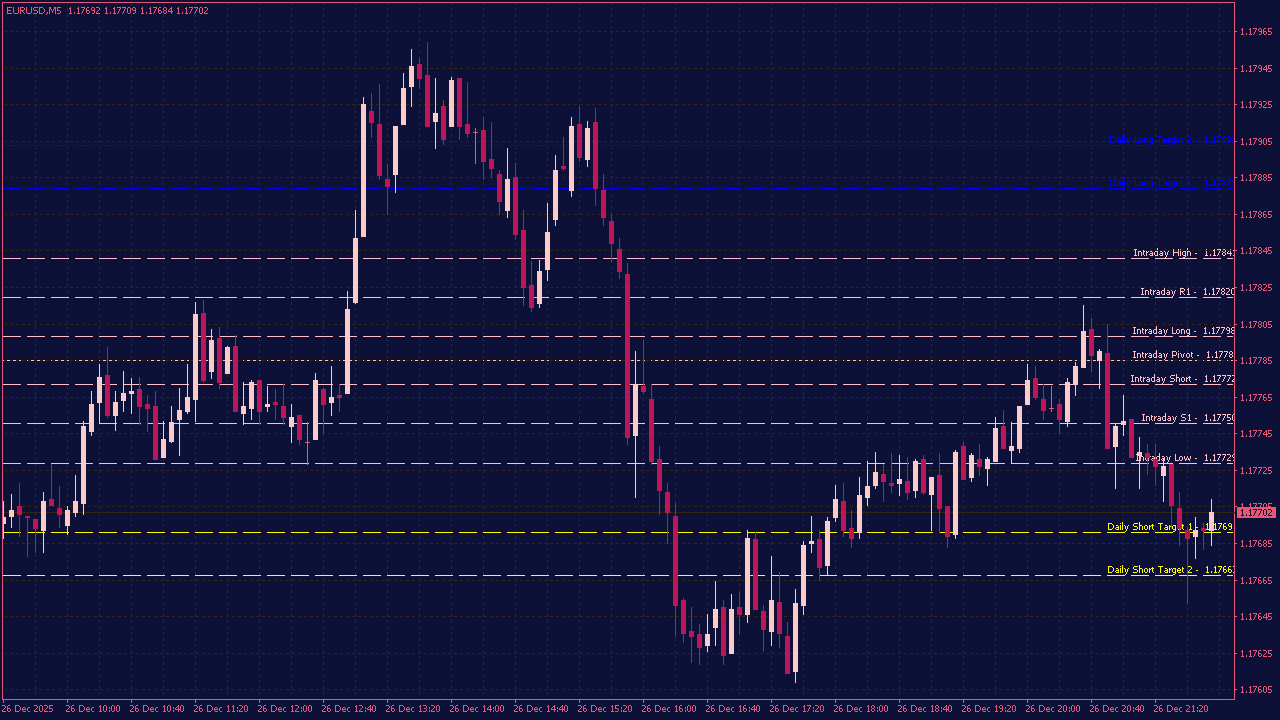

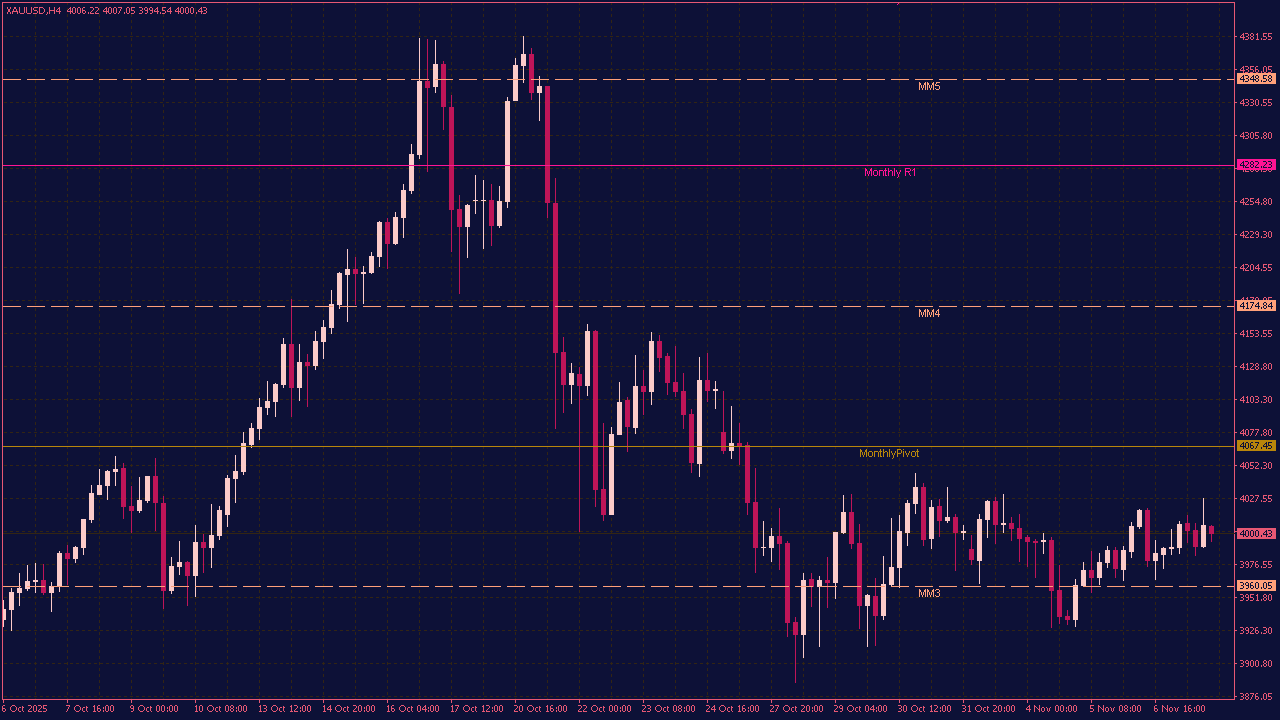

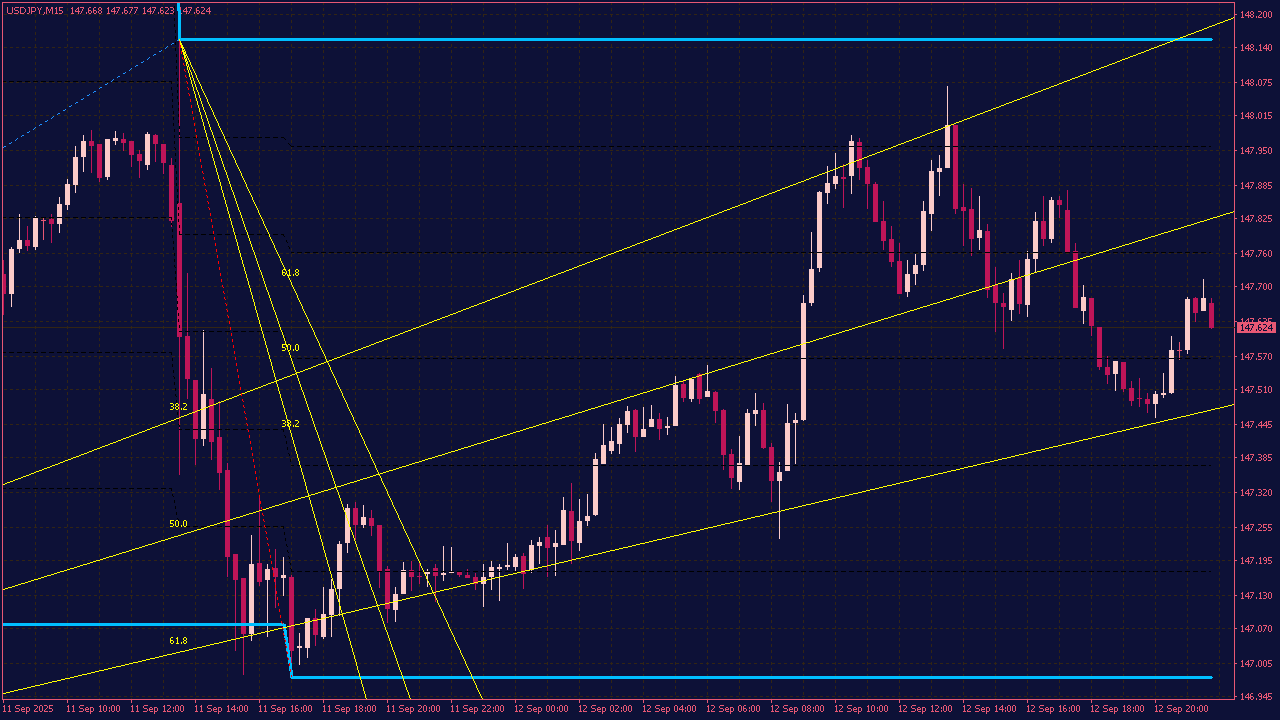

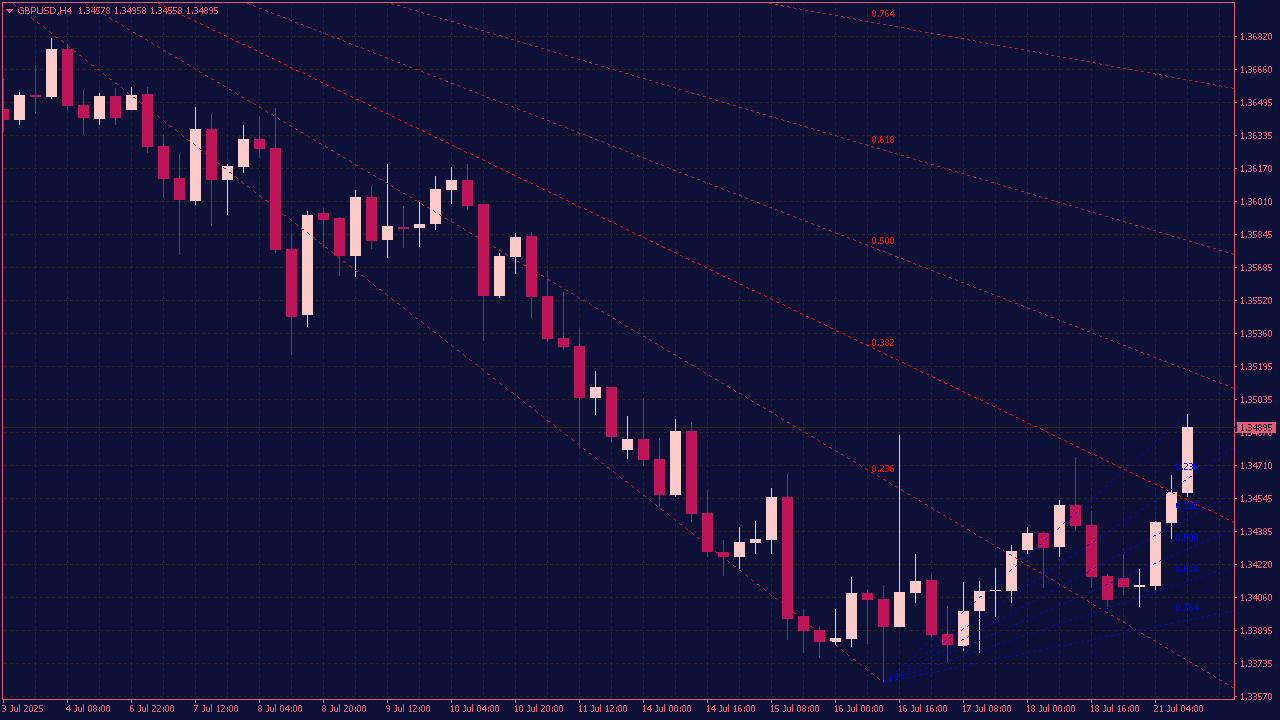

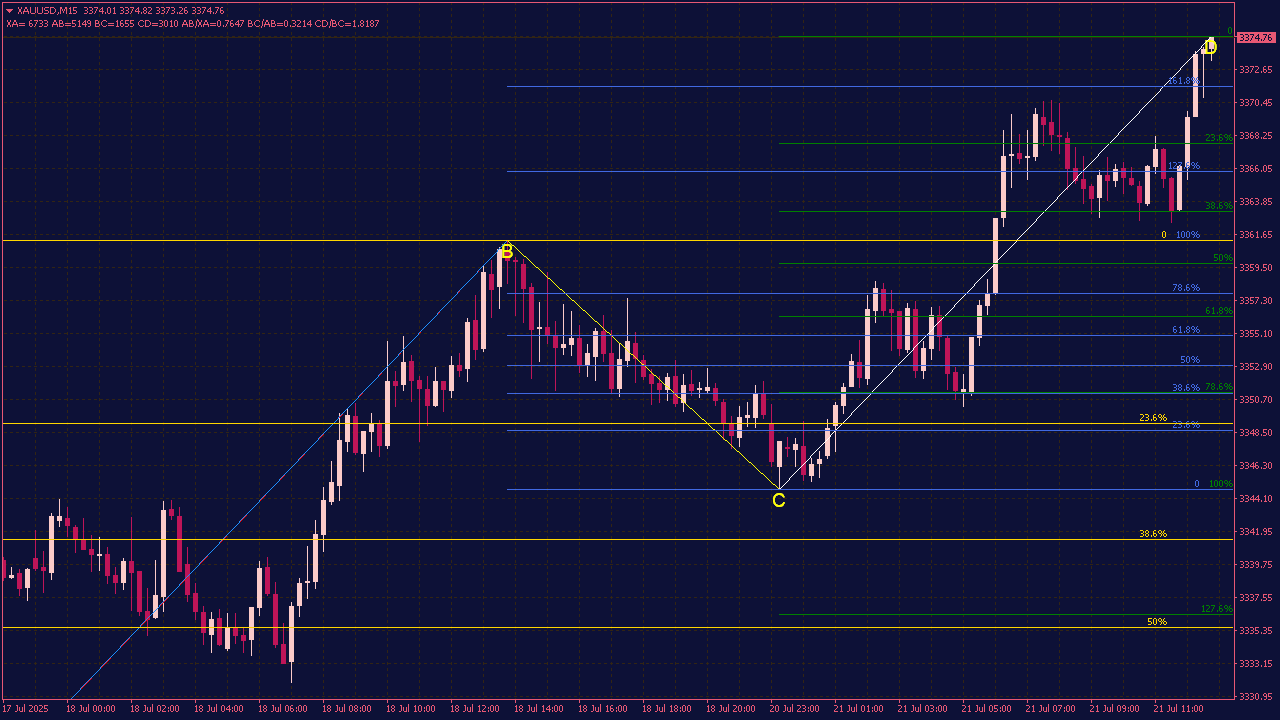

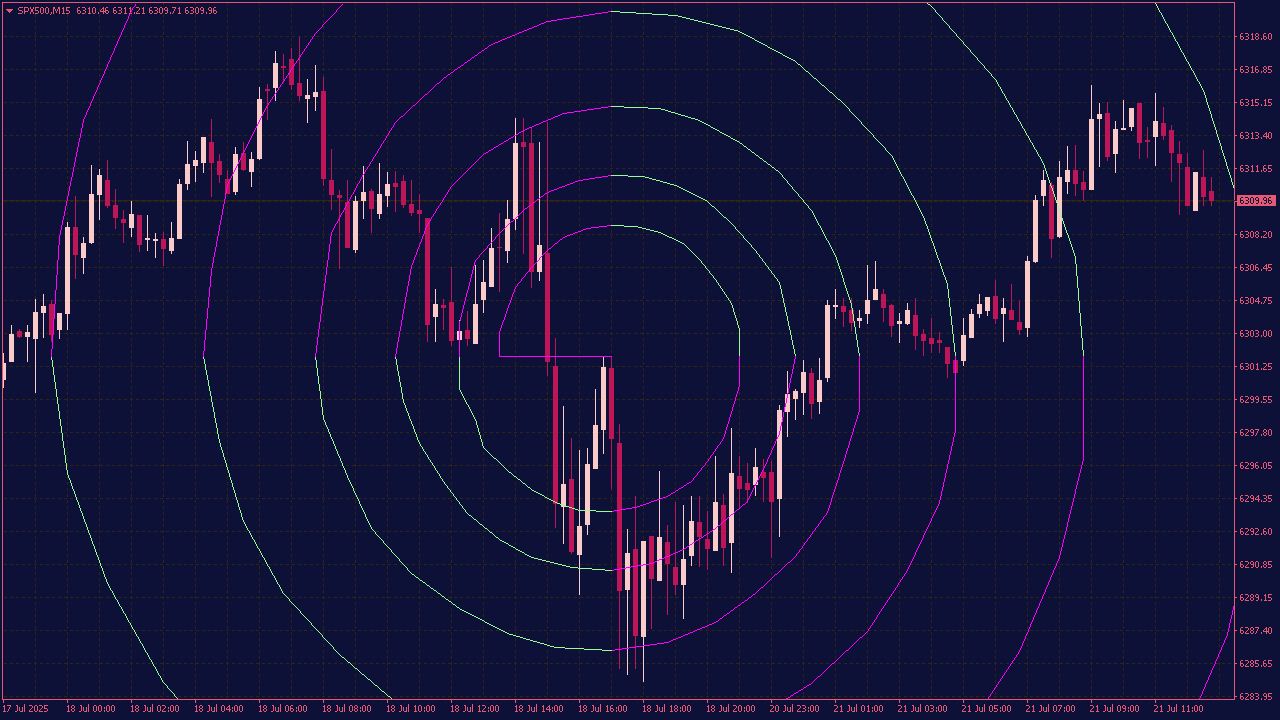

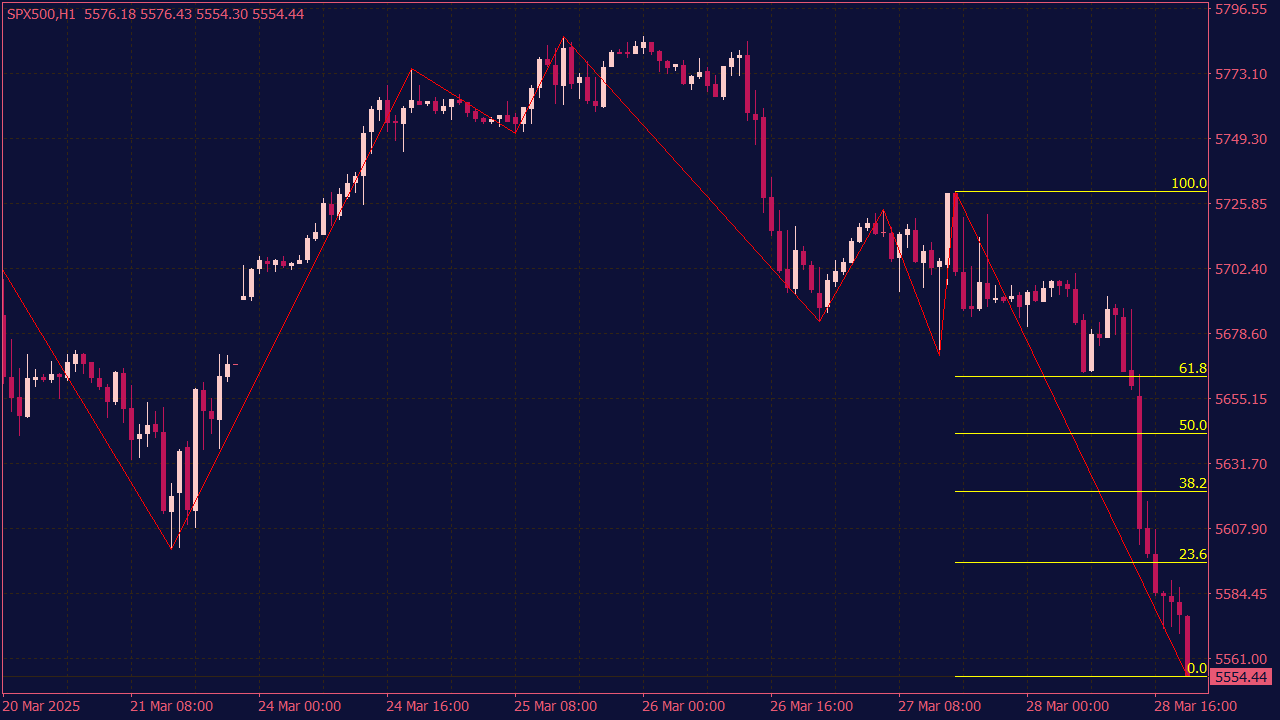

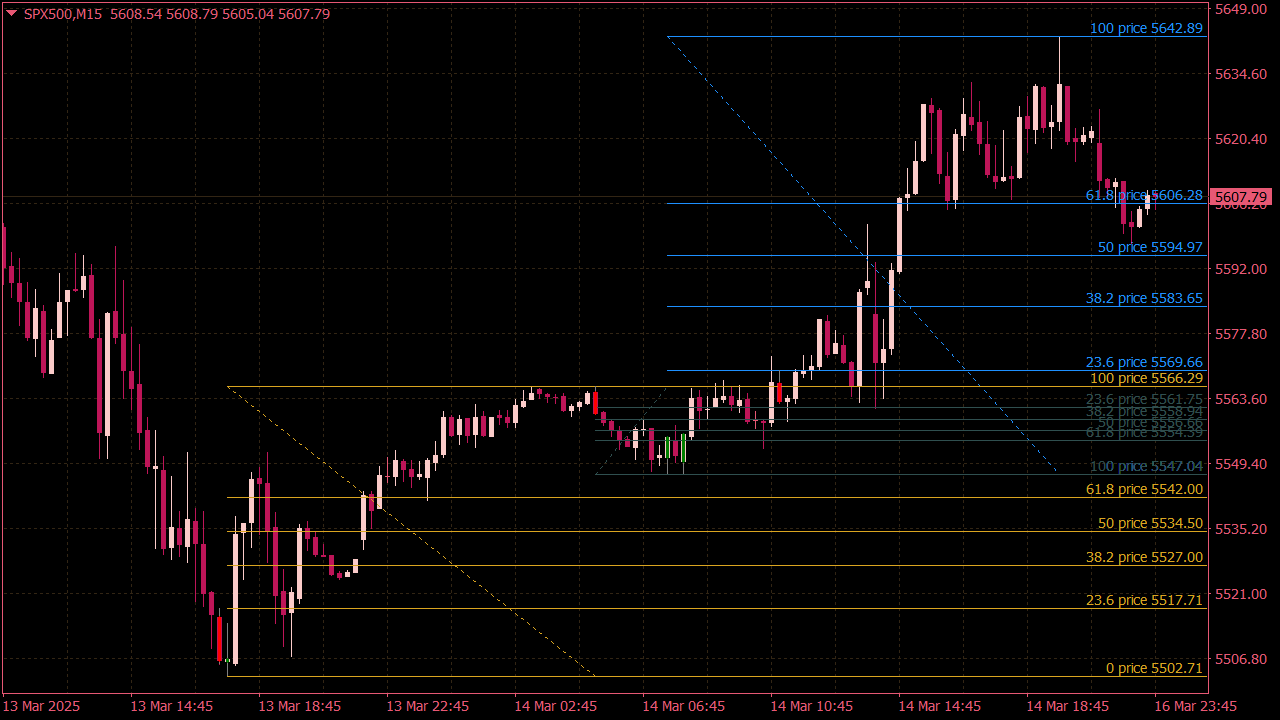

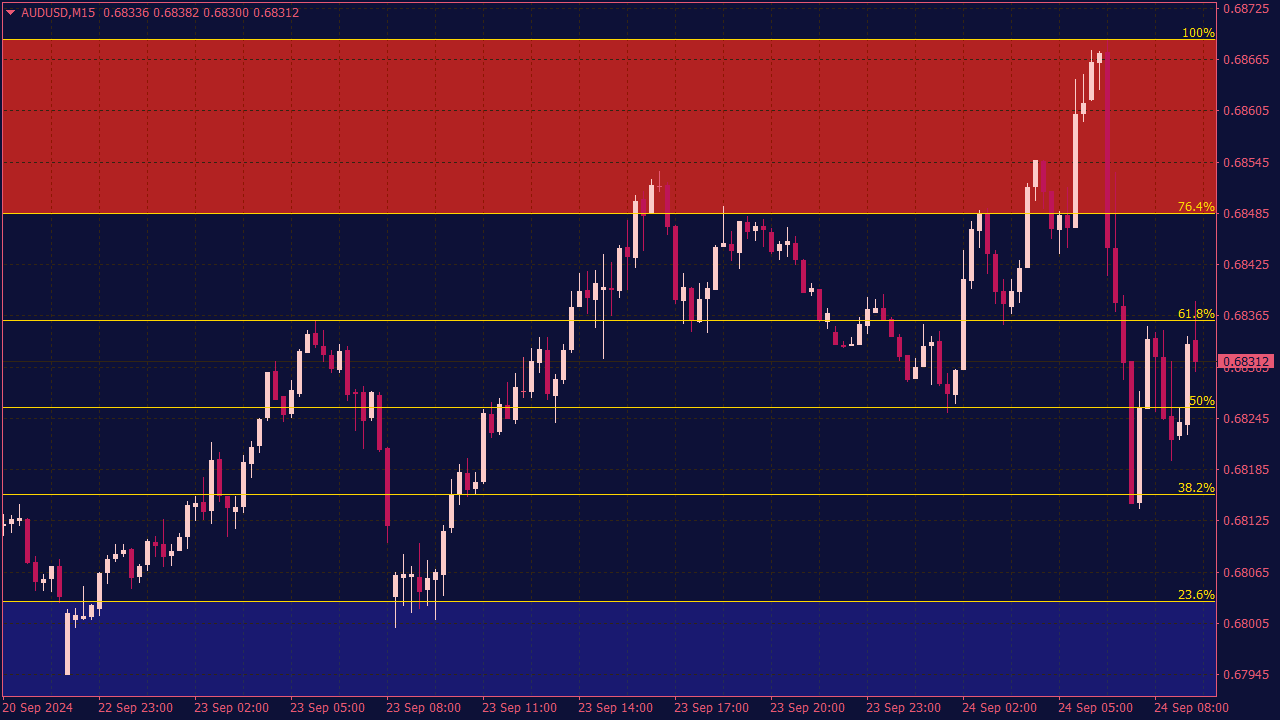

Auto Fibo Trade Zones Indicator

The Auto Fibo Trade Zones Indicator helps traders identify potential support and resistance levels based on Fibonacci retracement levels automatically plotted on the chart. To trade using this indicator, first select the desired timeframe and apply the indicator to your chart. Look for price action near the Fibonacci levels, specifically at key retracement levels (like 38.2%, 50%, and 61.8%) to identify potential reversal points. Traders often wait for confirmation through candlestick patterns or additional indicators before entering trades. Set stop-loss orders just outside the Fibonacci zone and target your risk-reward ratios based on the next Fibonacci level or established price action zones.