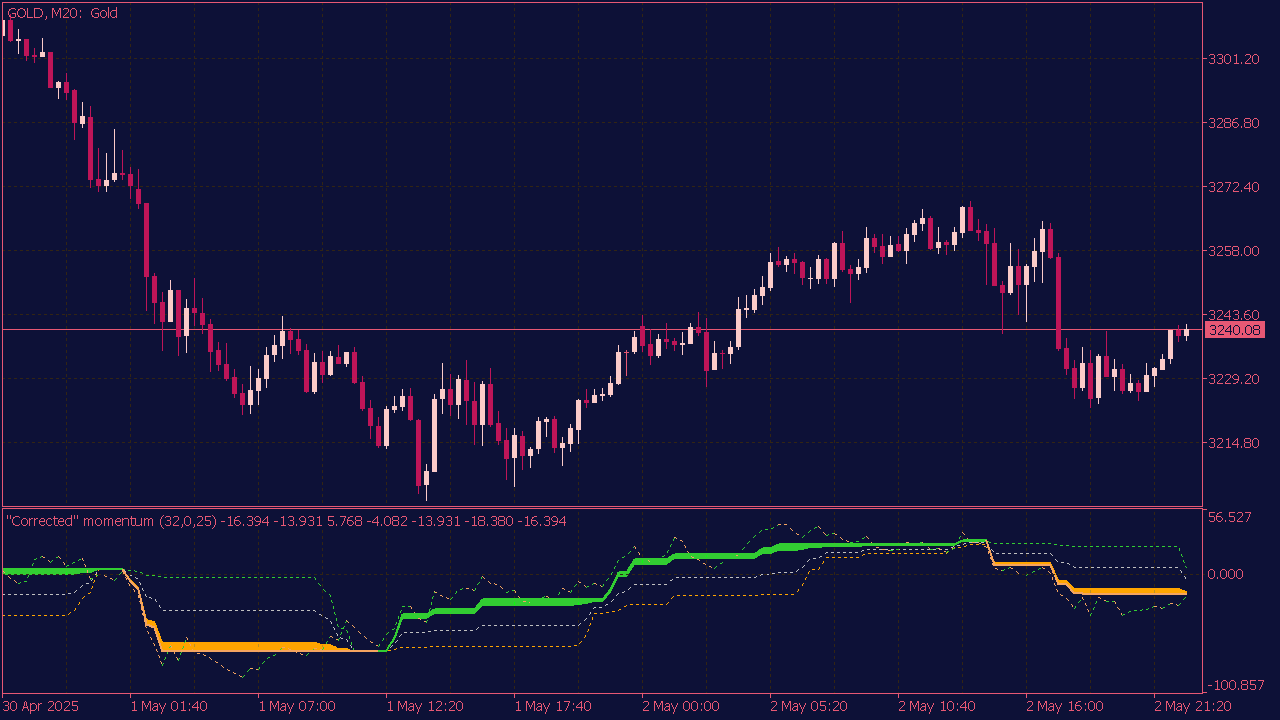

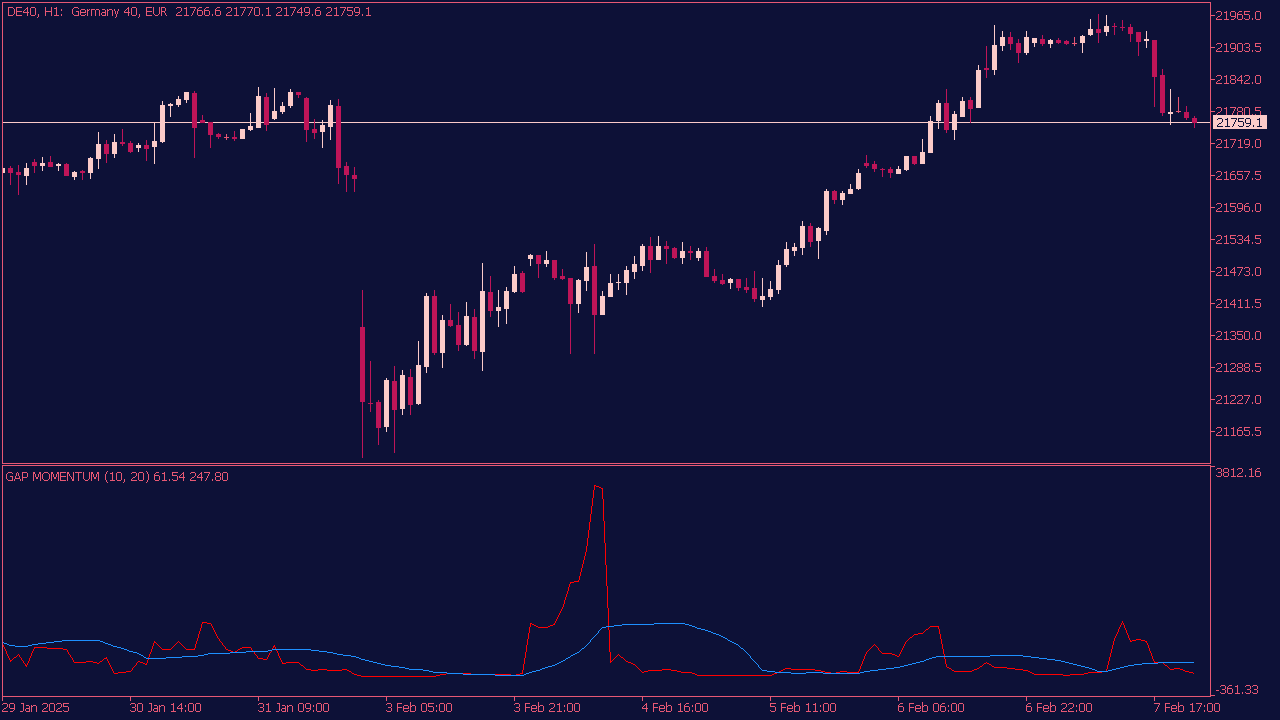

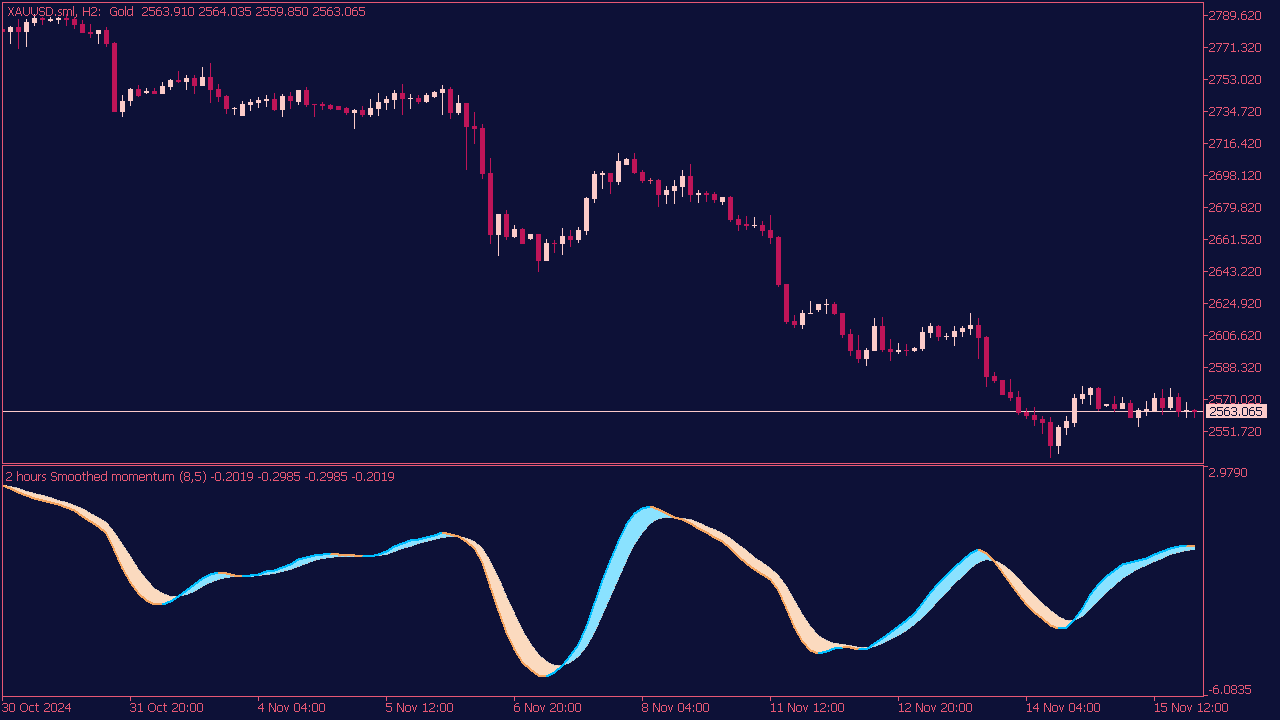

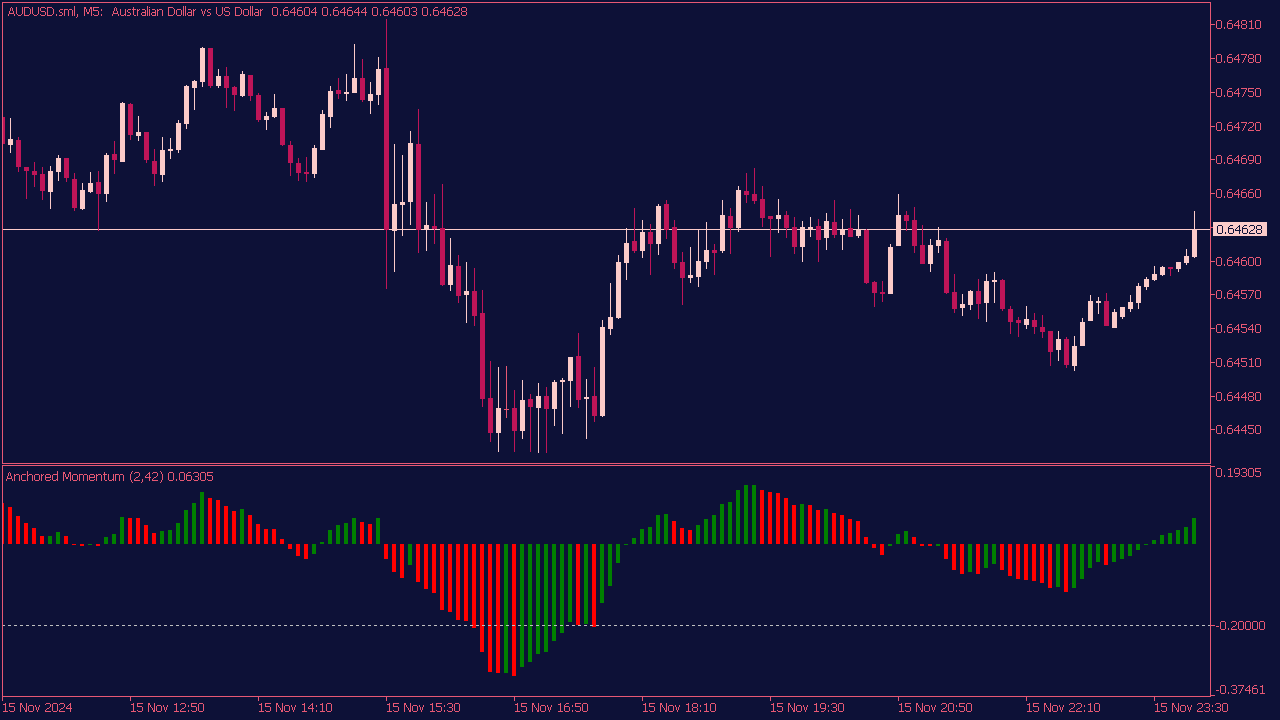

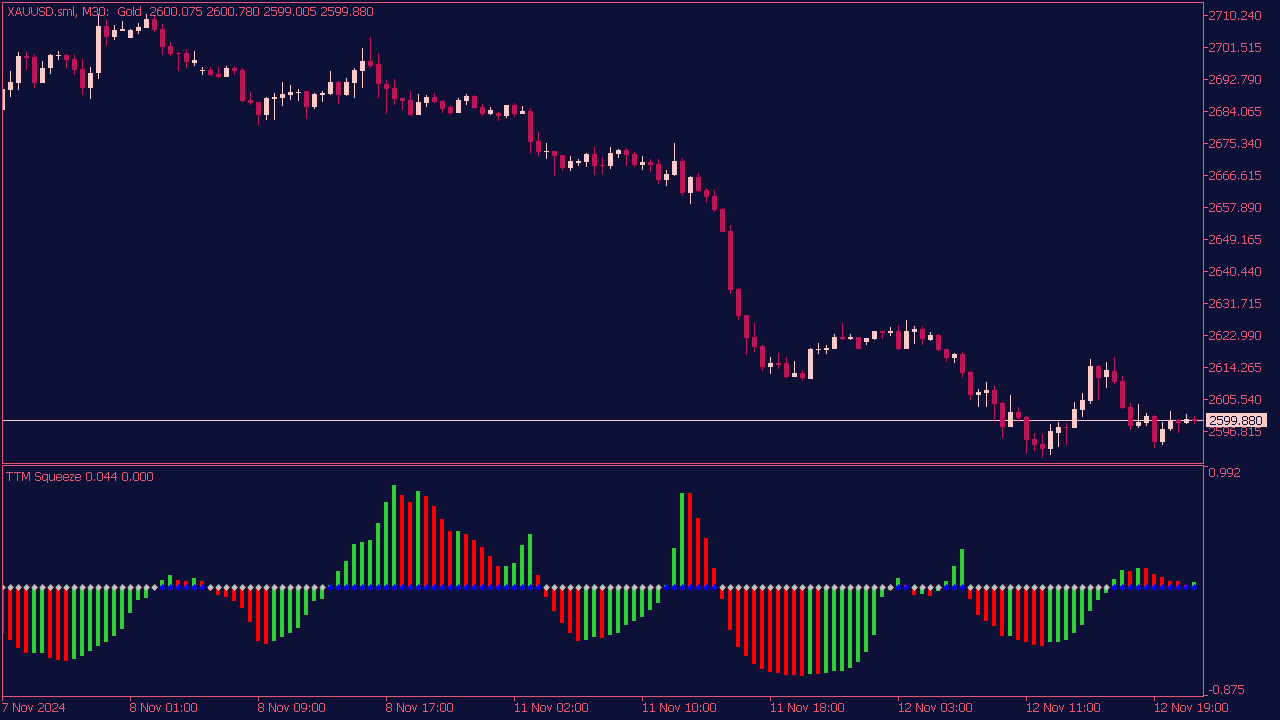

Squeeze Momentum Indicator

The Squeeze Momentum Indicator is used to identify potential breakout opportunities in the market. Entry signals typically occur when the indicator shows a squeeze, indicated by the Bollinger Bands constricting, followed by a breakout when the price moves outside of the bands. A bullish entry signal can be confirmed when the momentum histogram turns from red to green, suggesting a potential upward price movement, while a bearish entry signal occurs when the histogram transitions from green to red, indicating potential downward pressure. Traders often combine these signals with other technical analysis tools for validated entries.