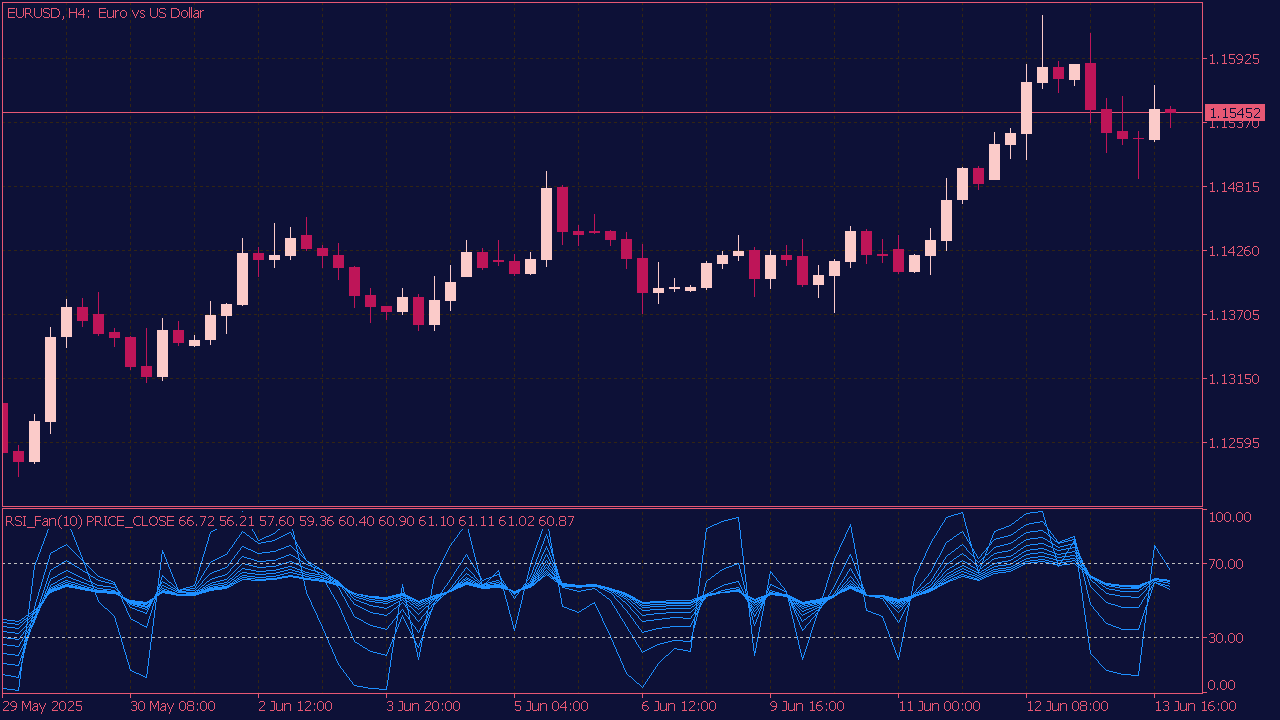

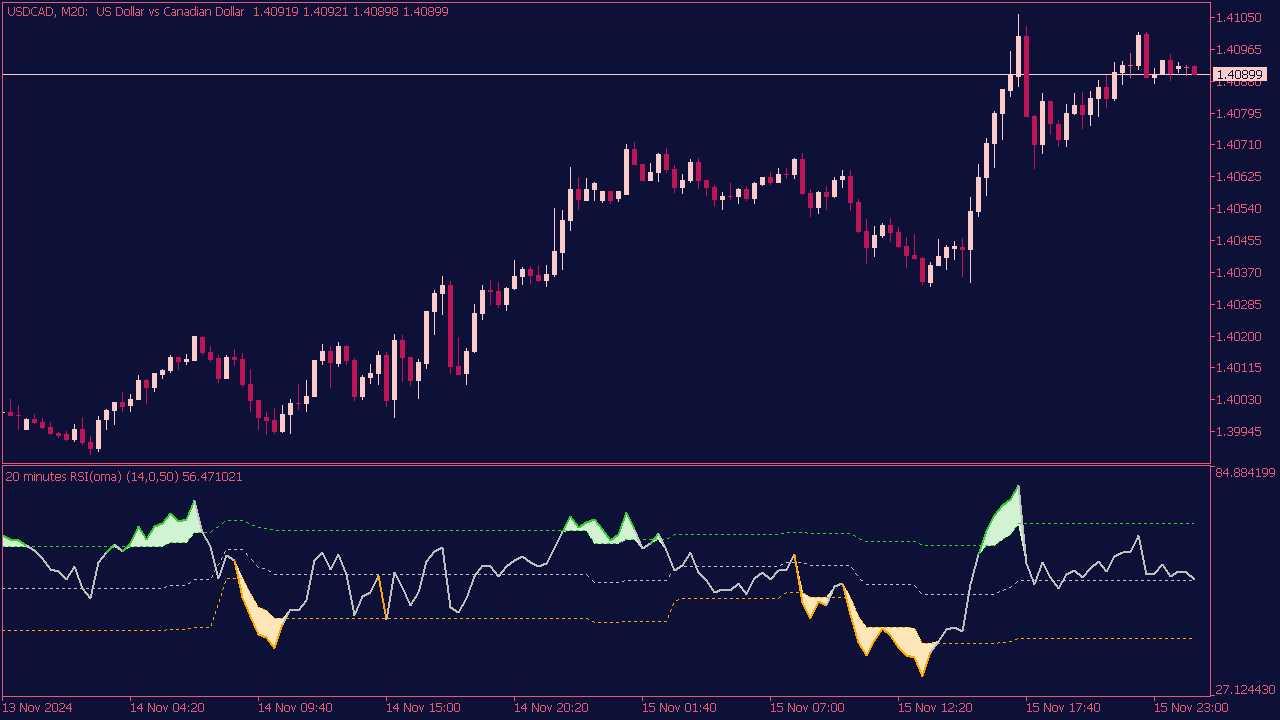

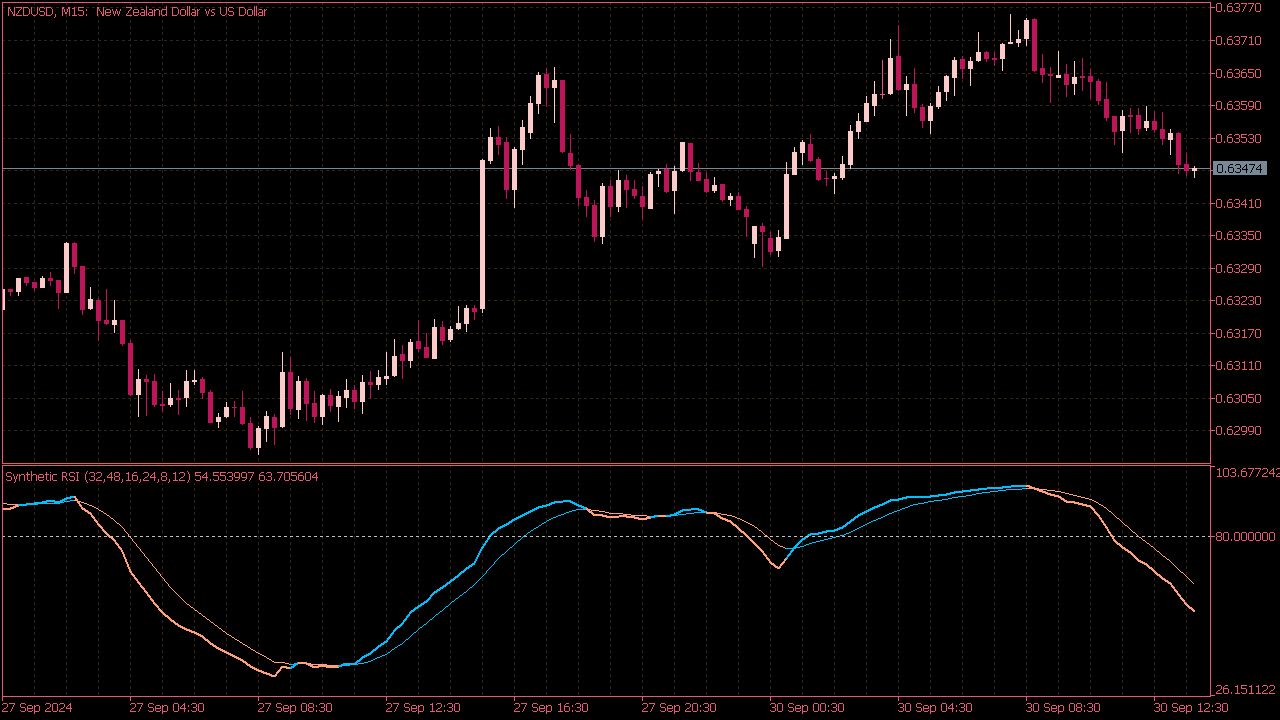

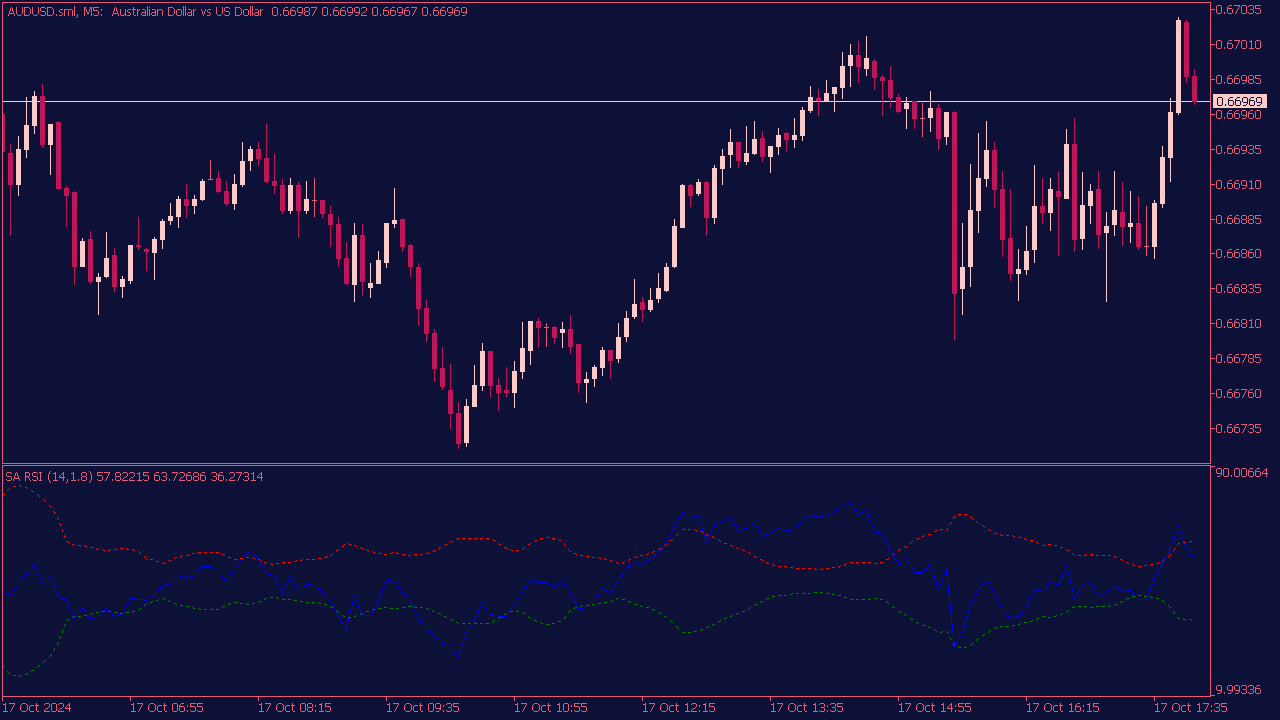

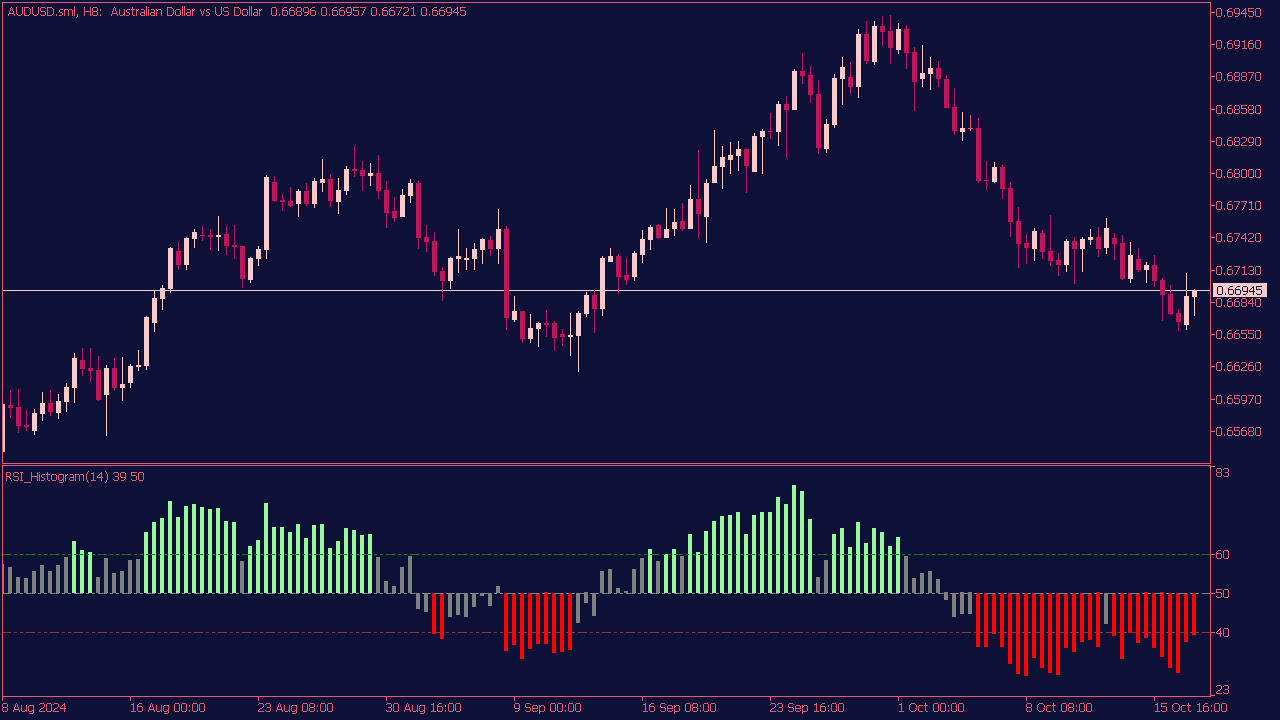

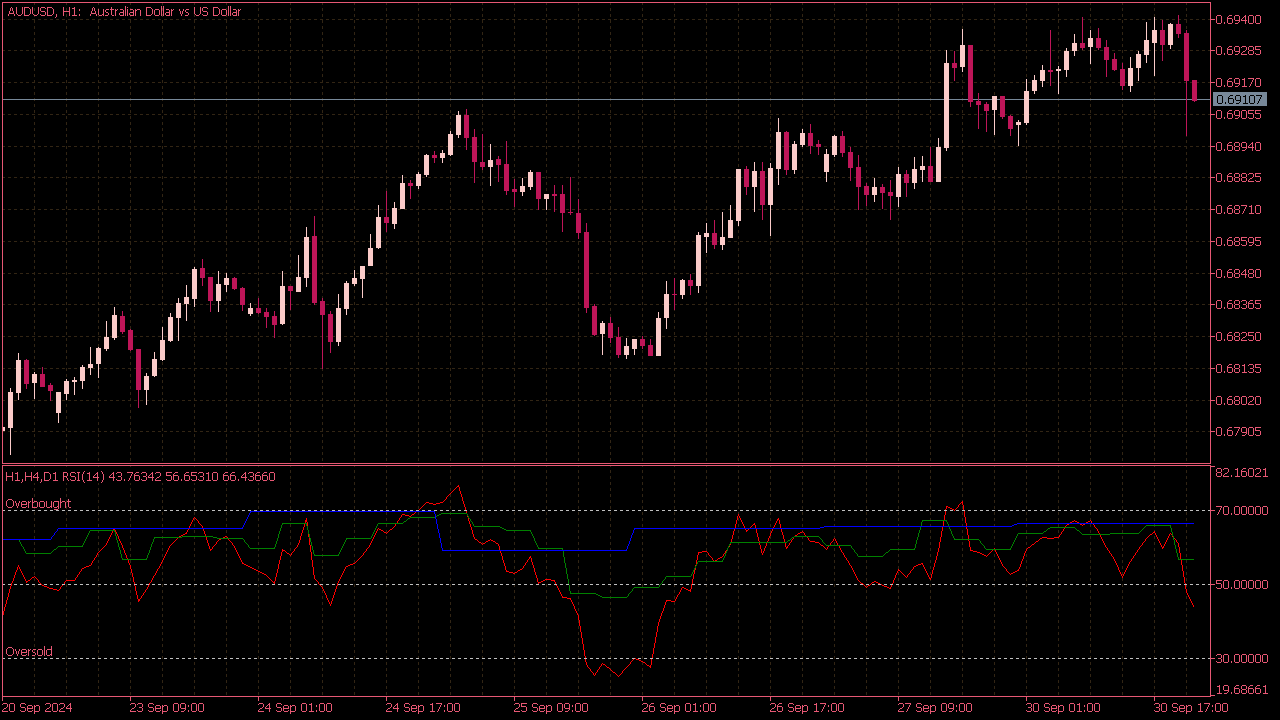

RSI Divergence Indicator

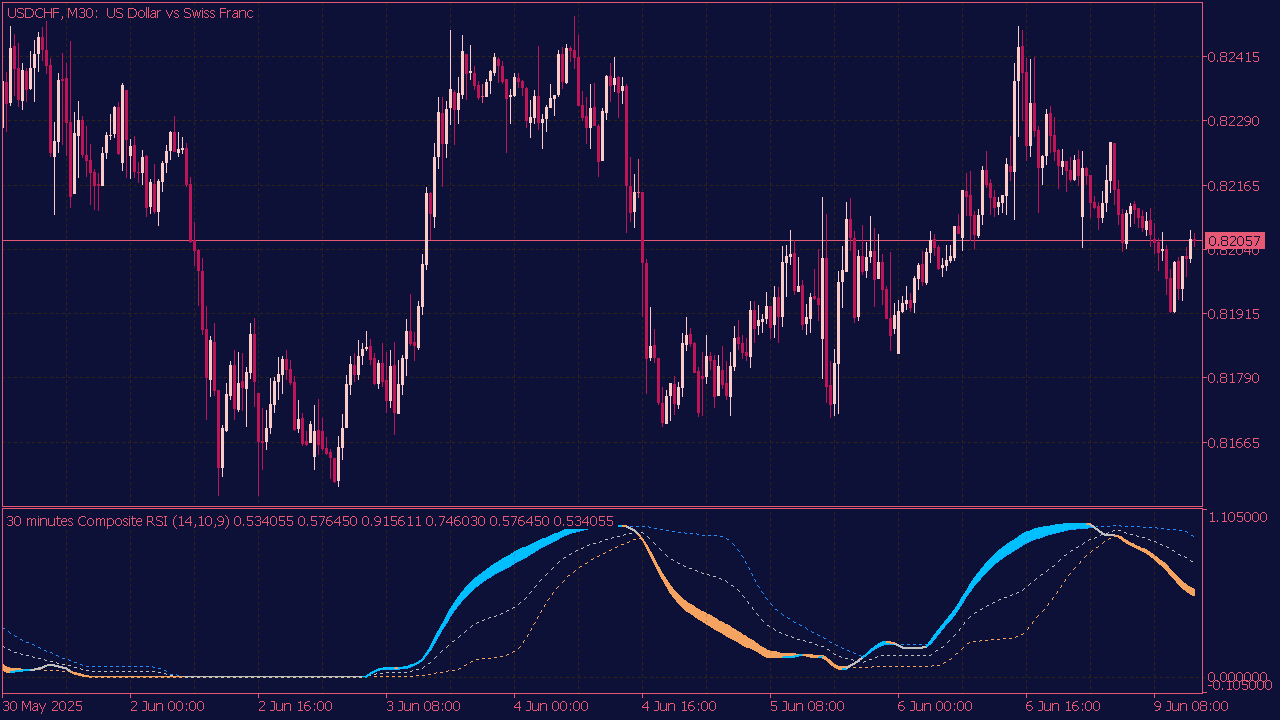

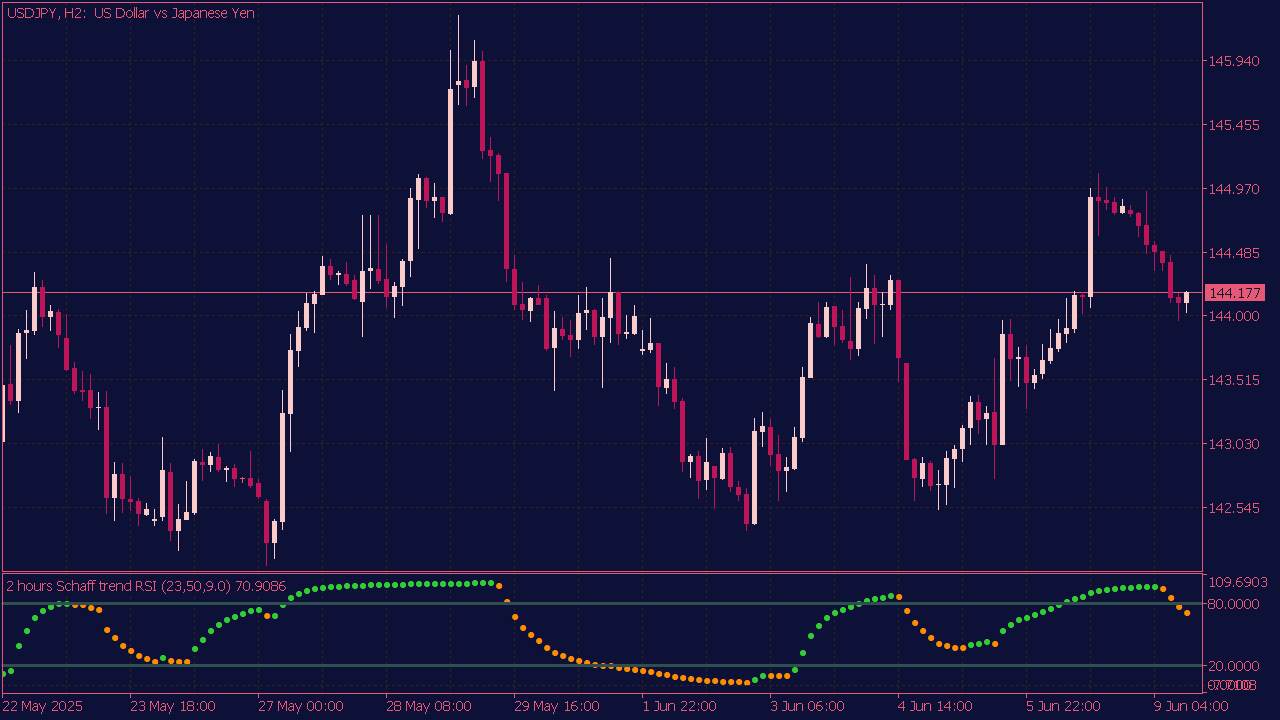

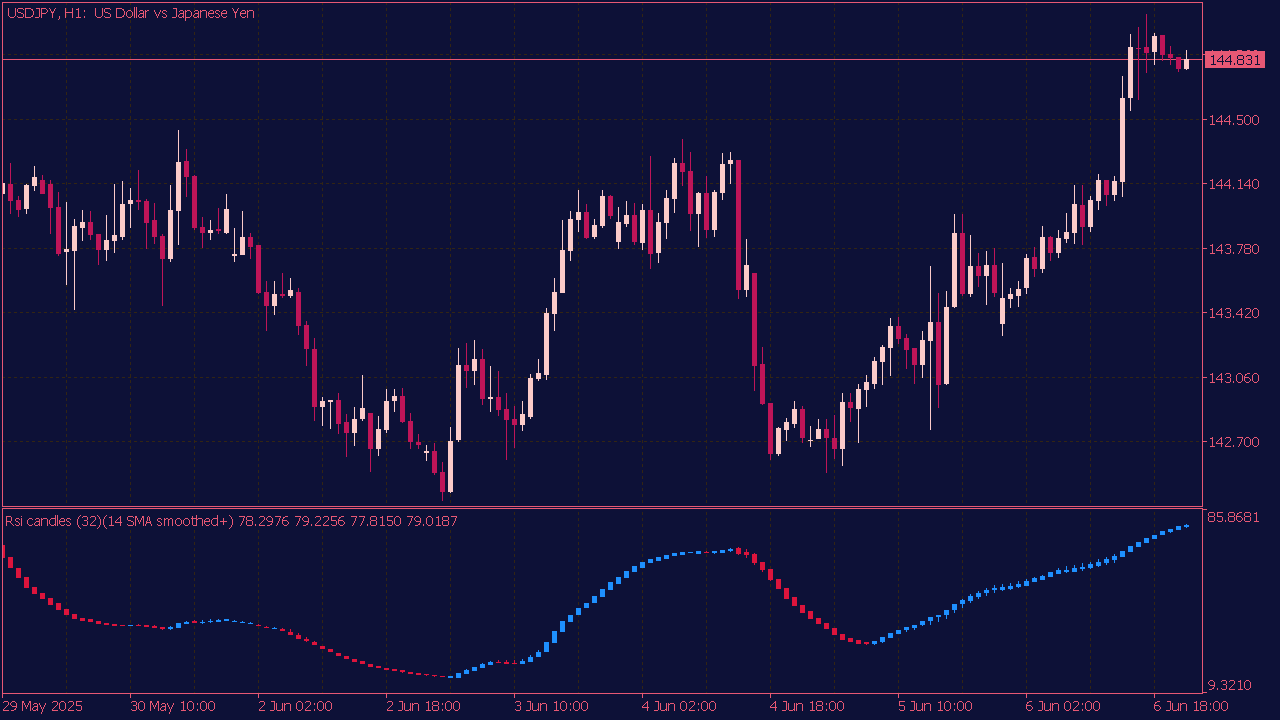

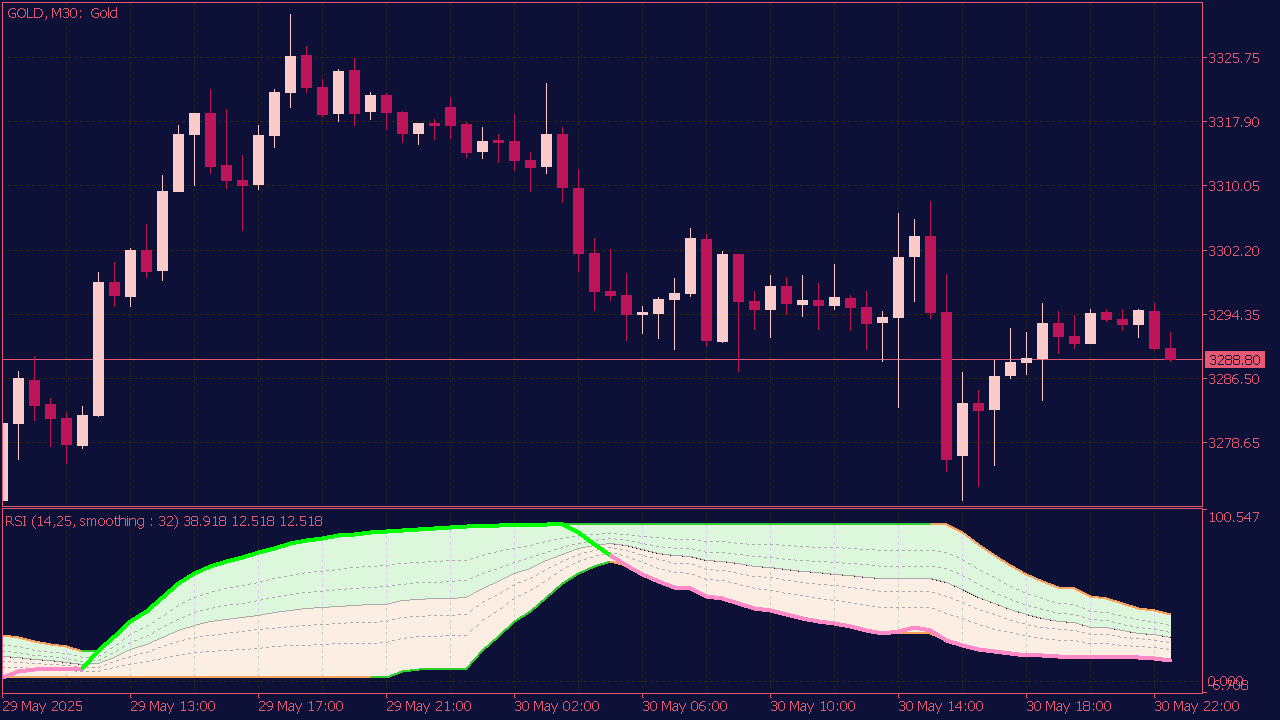

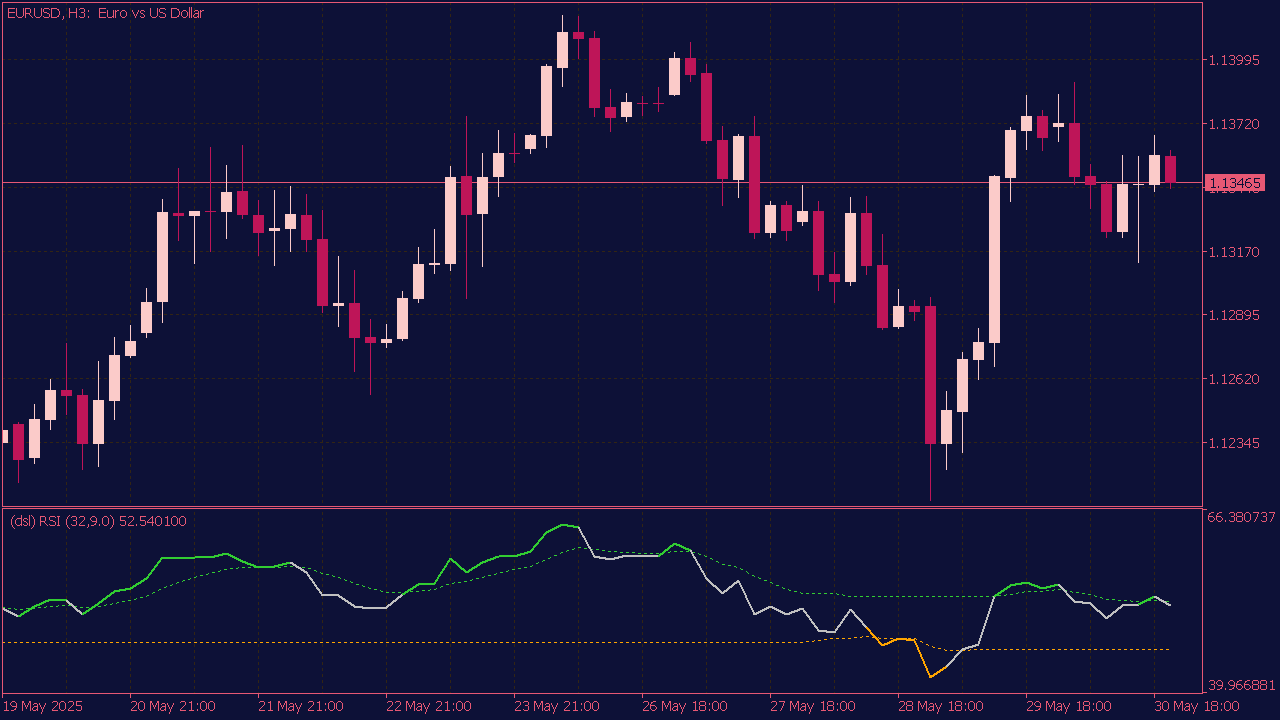

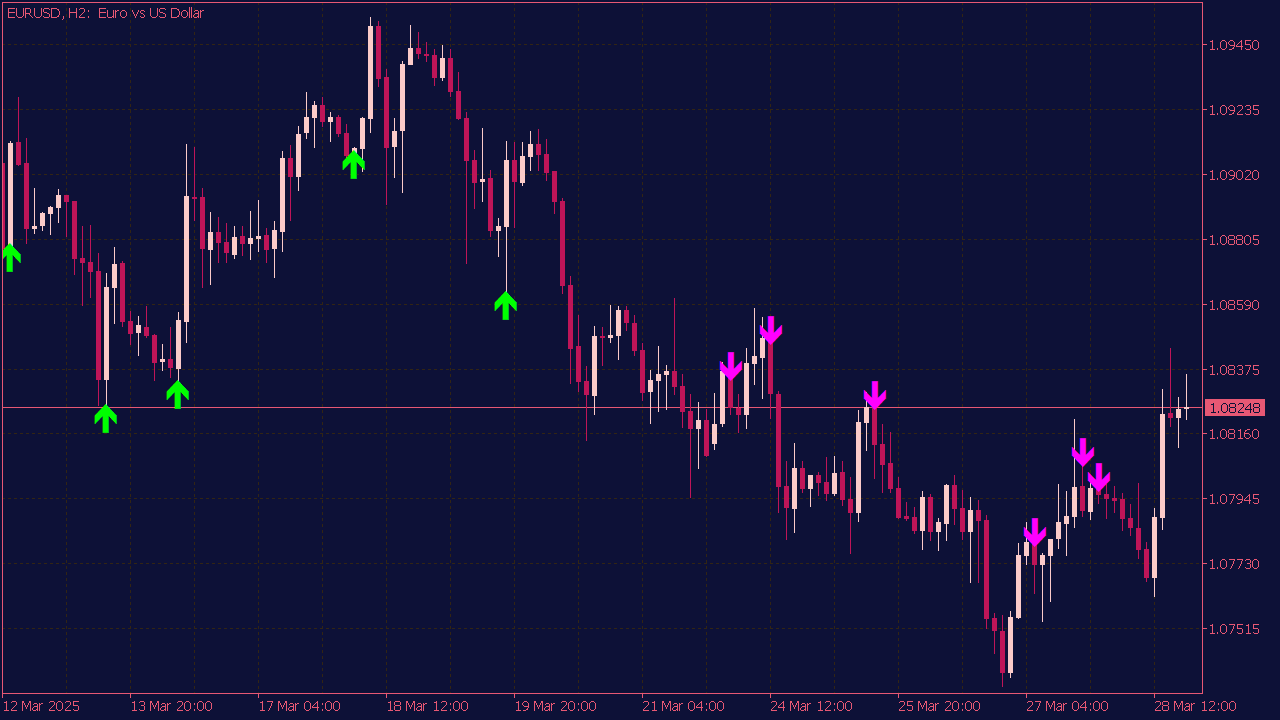

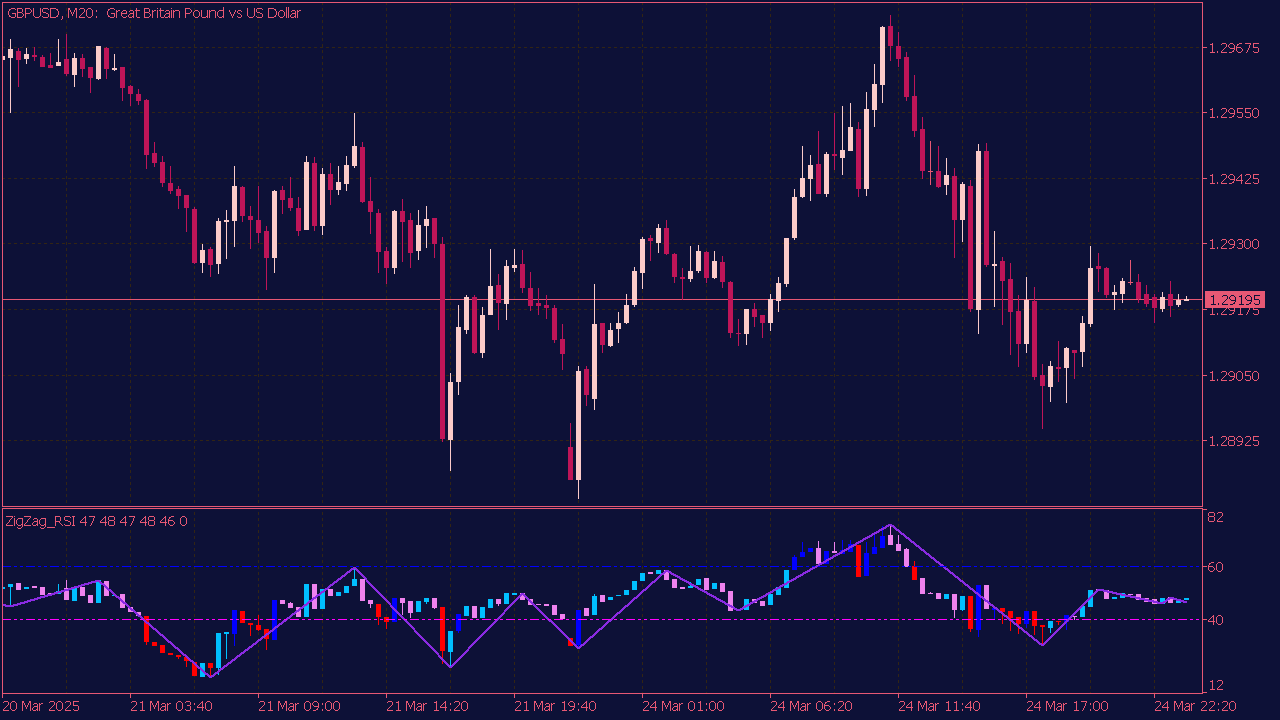

The RSI Divergence Indicator is a technical analysis tool used to identify potential reversals in the price movement of an asset by comparing the Relative Strength Index (RSI) with the price action. Divergence occurs when the price makes a new high or low, but the RSI does not, indicating a possible weakening trend. A bullish divergence occurs when prices decline to a new low while the RSI rises, suggesting a potential price increase ahead, while a bearish divergence occurs when prices increase to a new high while the RSI decreases, signaling a potential downturn. Traders often use this indicator in conjunction with other analysis methods to improve their decision-making.