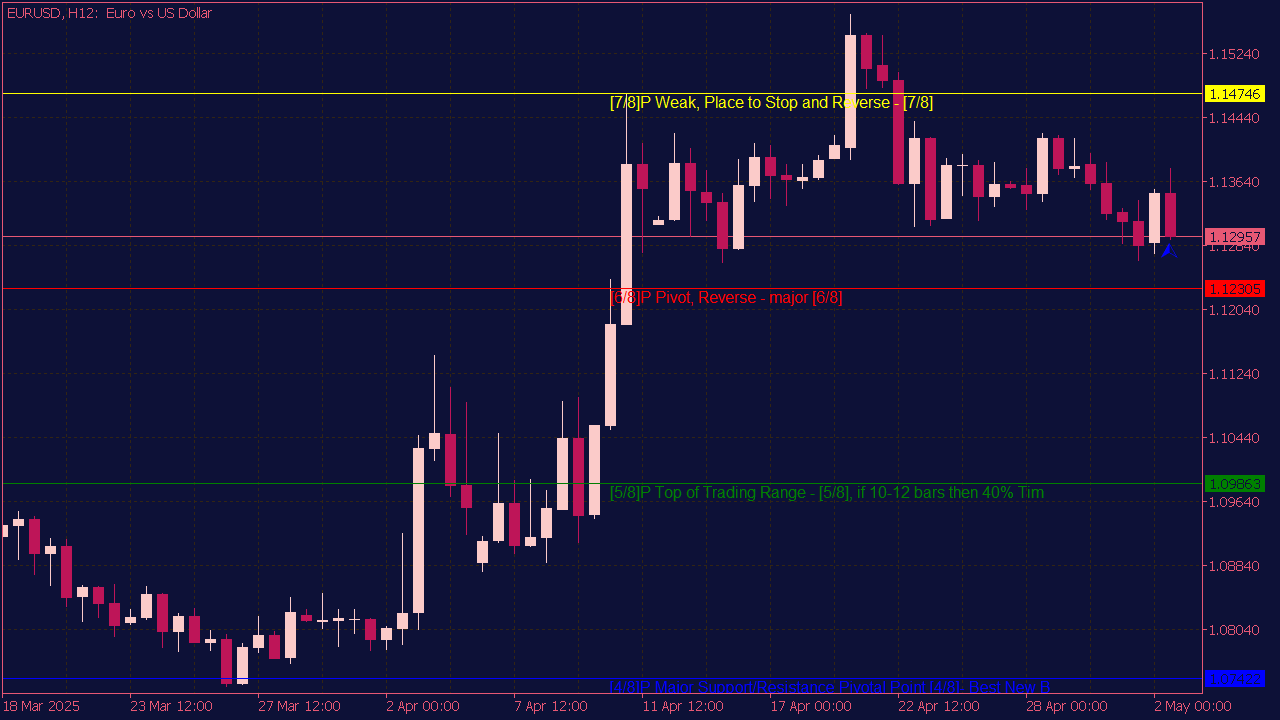

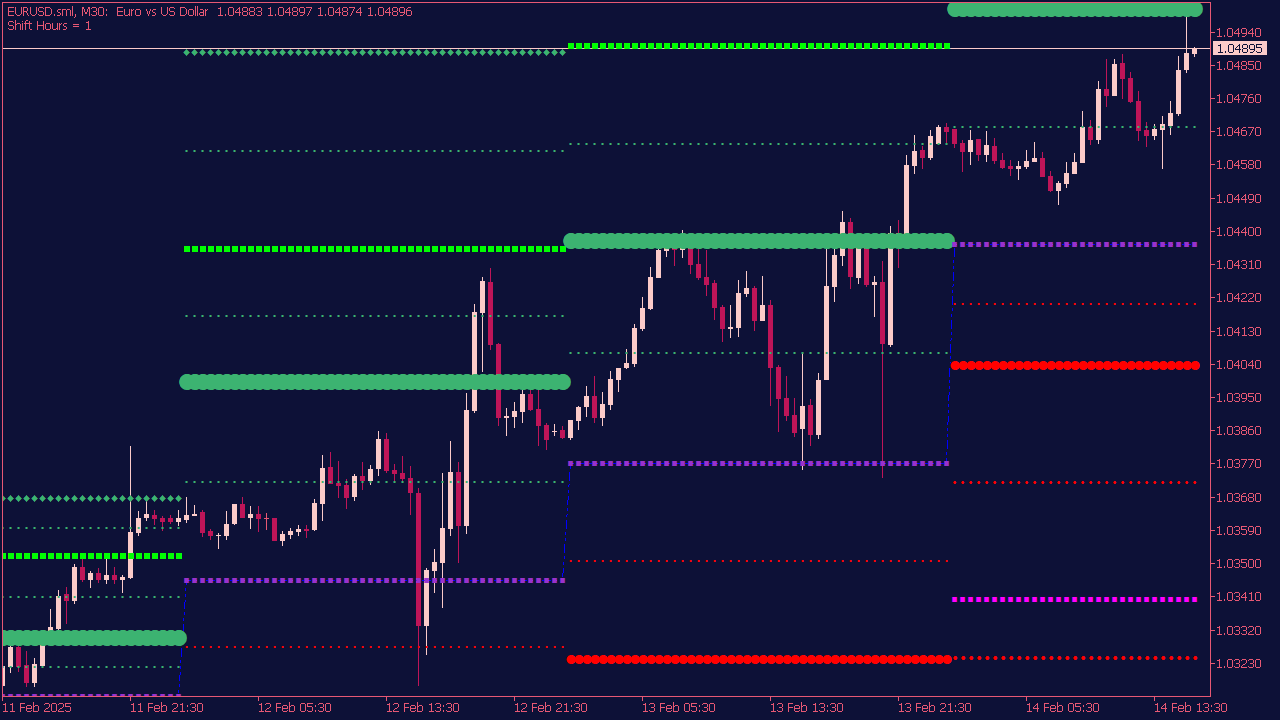

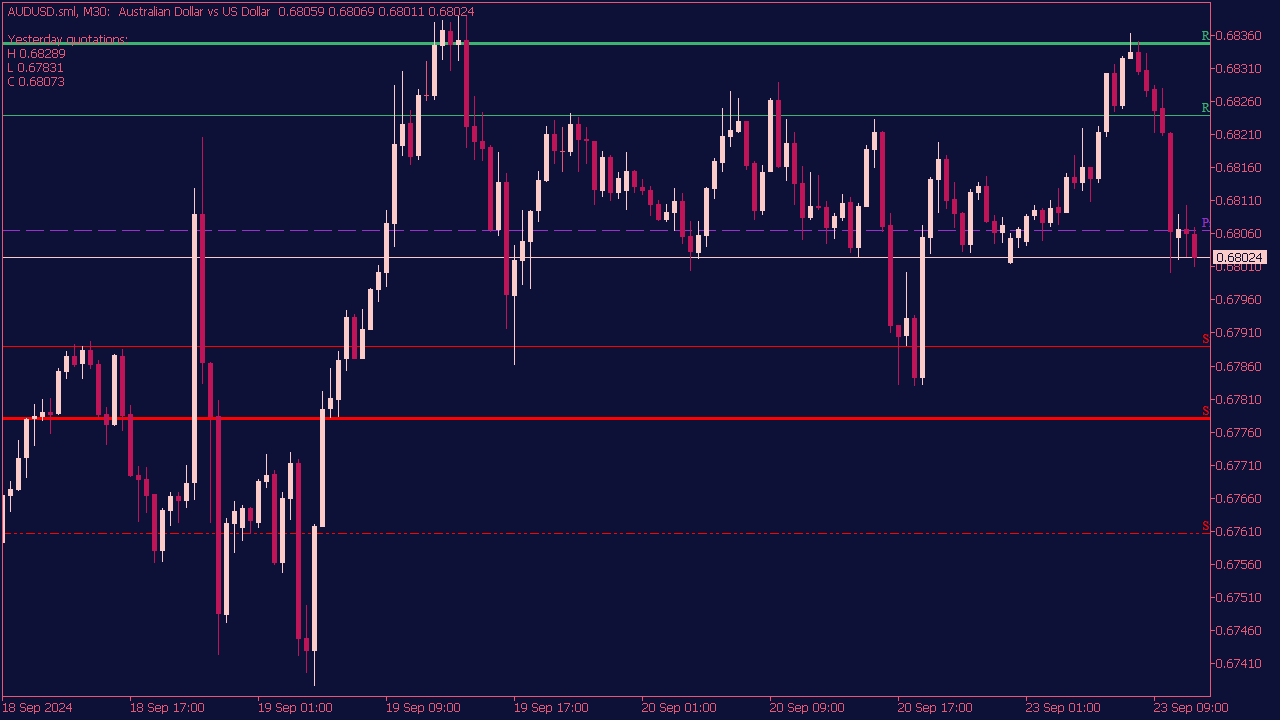

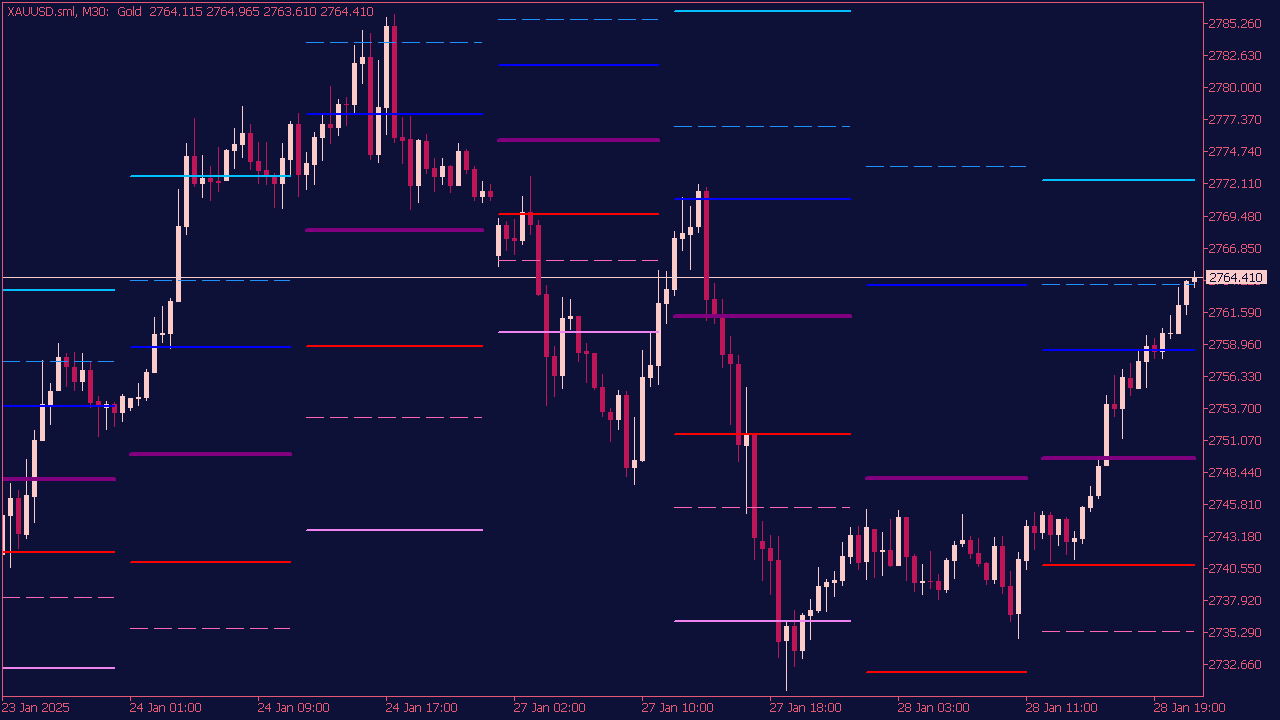

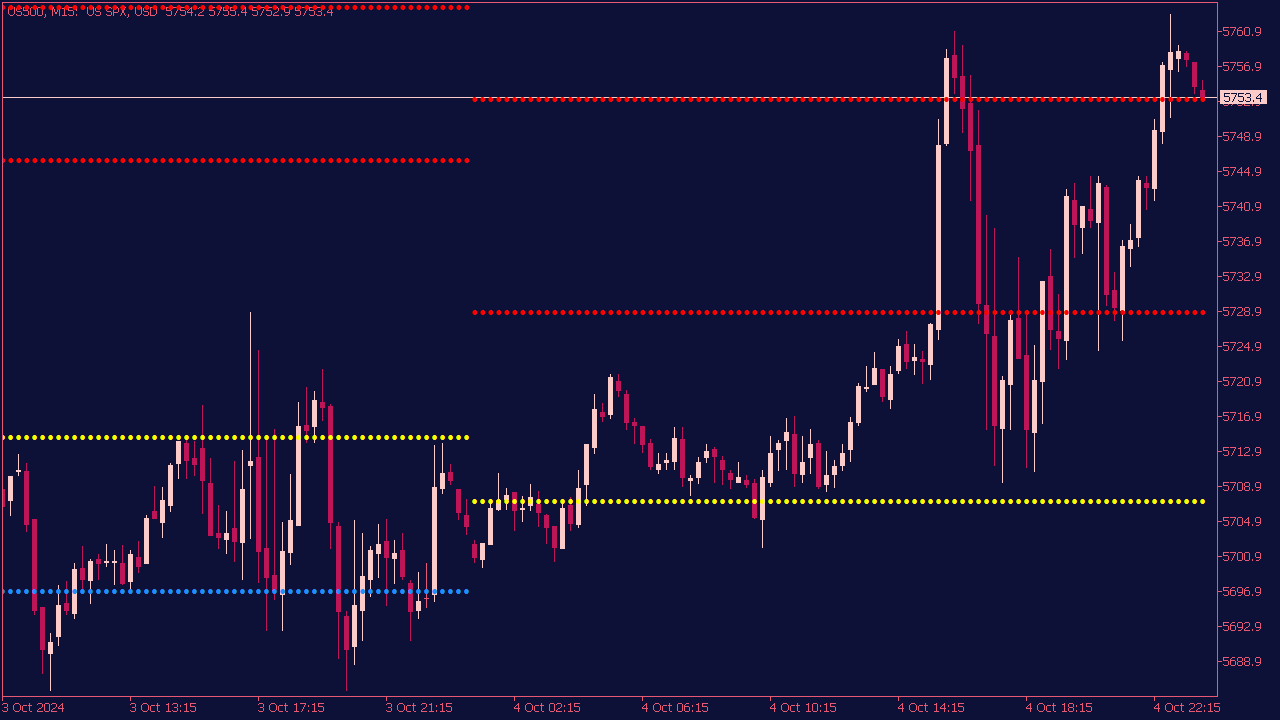

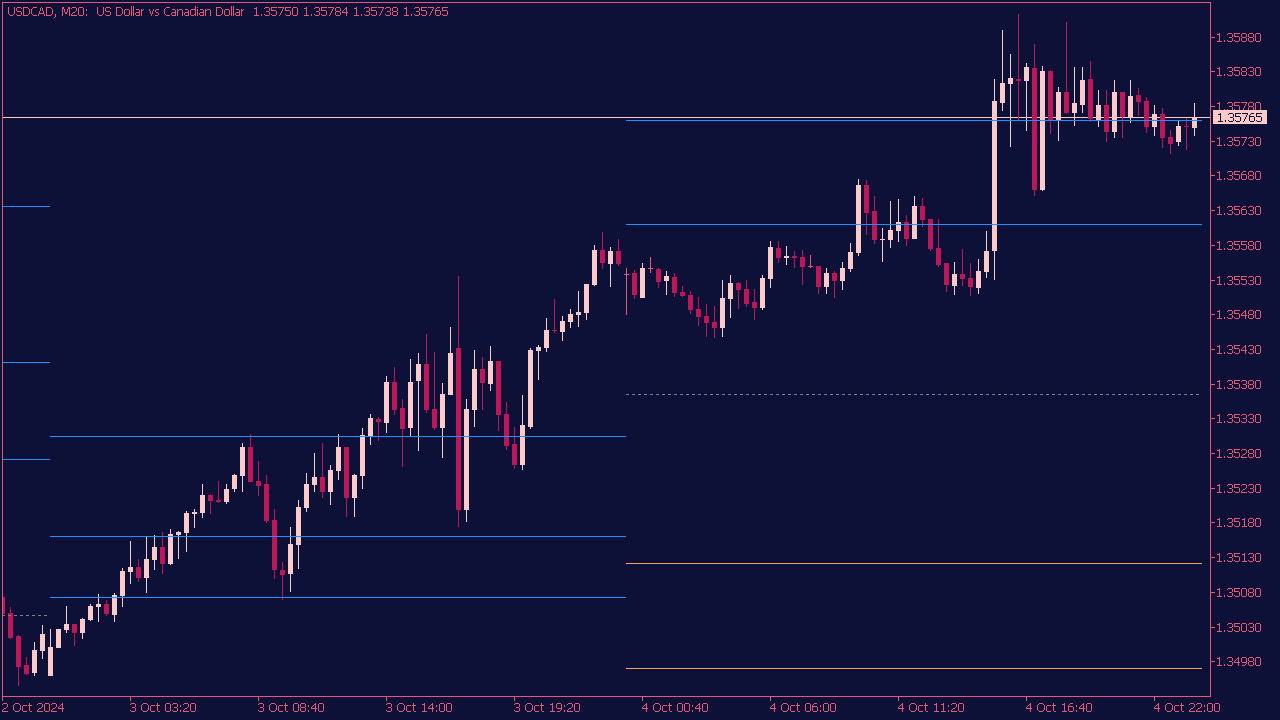

Auto Pivot Point Indicator

The Auto Pivot Point Indicator is a technical analysis tool used by traders to identify potential support and resistance levels in the financial markets. It automatically calculates pivot points based on historical price data, typically using the previous day's high, low, and close prices. These pivot levels can help traders determine entry and exit points for trades, as well as identify market trends and reversals. The indicator typically displays multiple levels, including the main pivot point, support levels below it, and resistance levels above, facilitating informed decision-making in trading strategies.