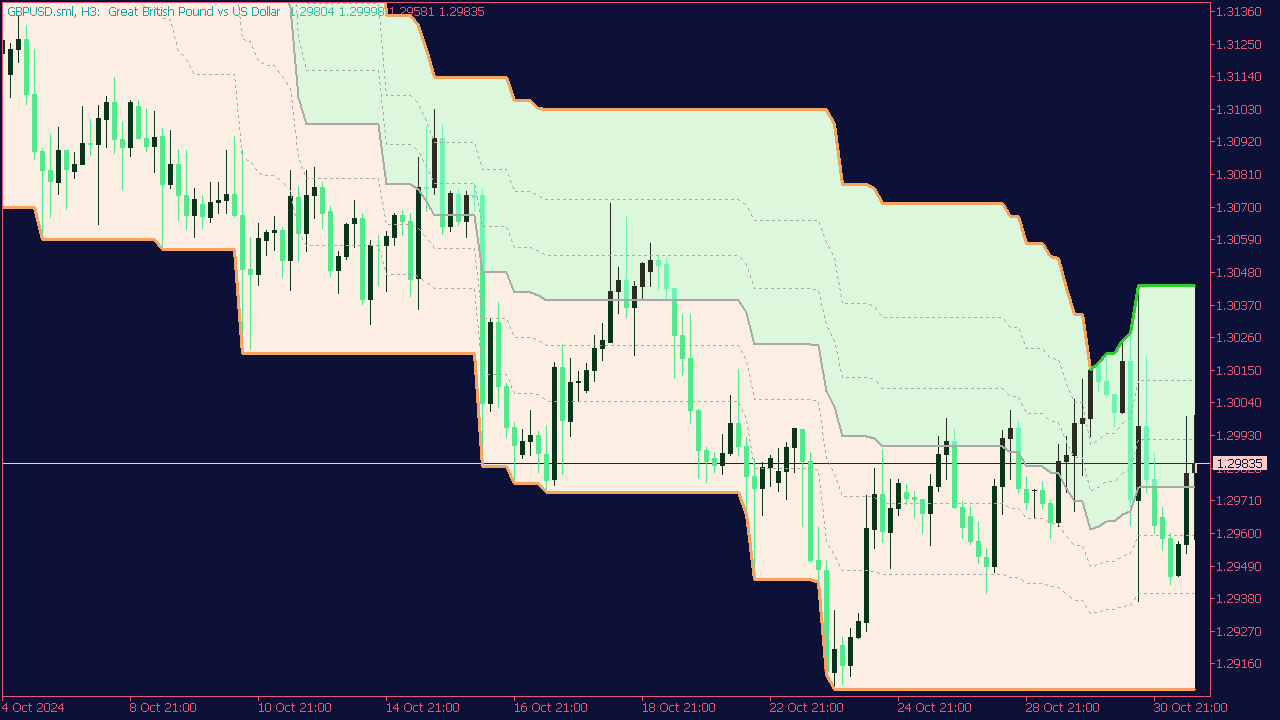

The Auto Fibonacci Indicator for MT5 automatically identifies key Fibonacci levels on price charts, aiding traders in visualizing potential support and resistance zones. This tool typically analyzes recent price movements to draw Fibonacci retracement and extension levels, allowing traders to make informed decisions based on historical price behavior. Users can customize settings such as the lookback period and visual styles to enhance usability. It's essential to ensure that any indicator aligns with your trading strategy and risk management approach before relying on it for trading decisions.

Tips for Using Auto Fibonacci Indicator:

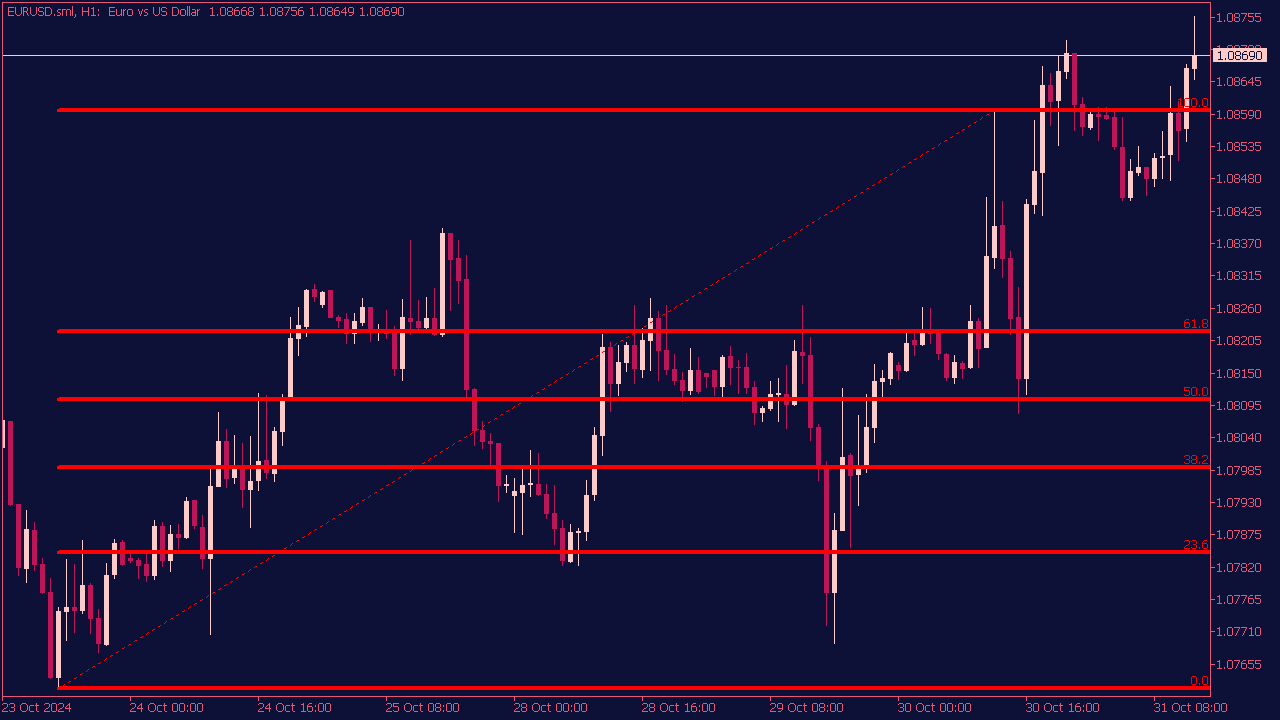

1. Time Frame Selection: Use higher time frames (H1 or H4) for more reliable Fibonacci levels, as they encompass more significant price movements.

2. Confirmation: Always seek additional confirmation from other indicators (e.g., RSI, MACD) or chart patterns before entering trades at Fibonacci levels. This helps increase the probability of successful trades.

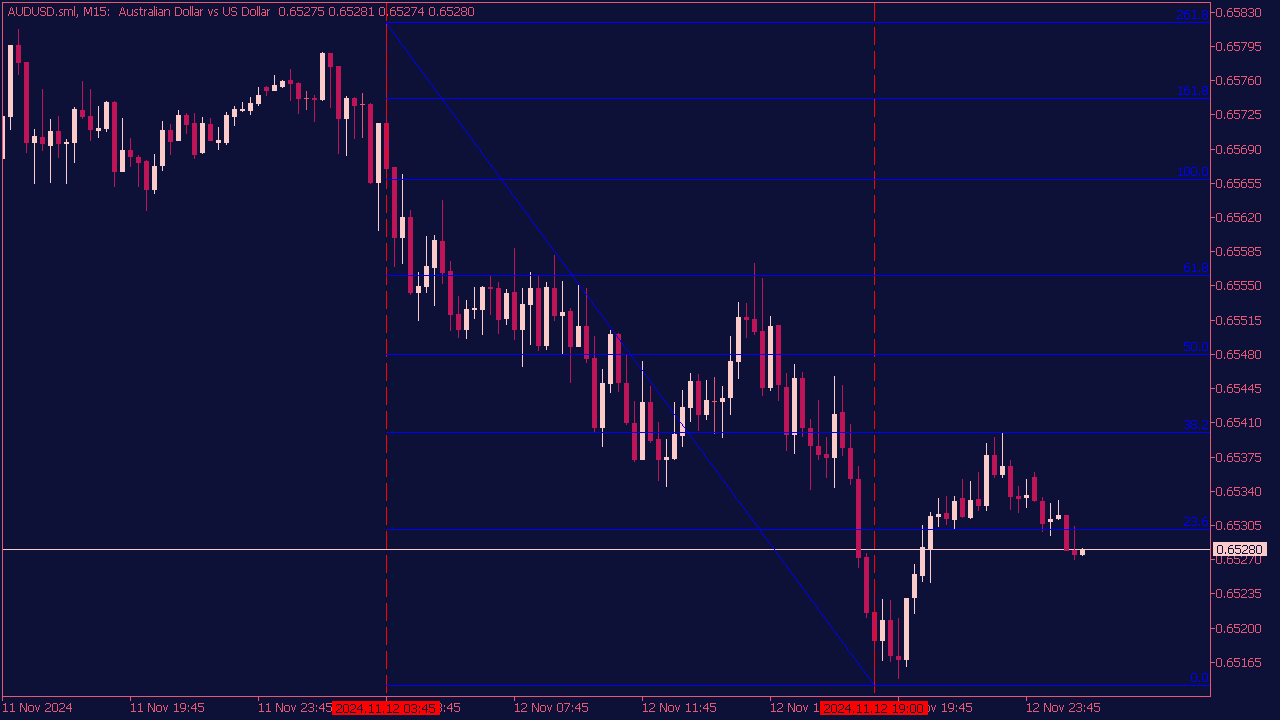

3. Risk Management: Set stop-loss orders slightly beyond the next Fibonacci level to minimize risk. Ensure your risk-to-reward ratio is at least 1:2 for effective trading.

Trading Rules:

1. Identify Trend: Determine the prevailing trend (upward or downward) before relying on Fibonacci levels. Use the Auto Fibonacci Indicator to pinpoint retracement levels during a pullback or continuation opportunity.

2. Entry Point: Enter buy orders near the 61.8% retracement in an uptrend and sell orders near the same level in a downtrend, as this is often where the trend resumes.

3. Exit Strategy: Take profits before the next Fibonacci levels, particularly at 38.2% or 50%, to secure gains while allowing some breathing space for price movements.

Strategies:

1. Confluence Trading: Combine Fibonacci retracement levels with other technical indicators such as moving averages and trend lines. A confluence of signals at a Fibonacci level can strengthen the case for a trade.

2. Scalping Strategy: For short-term traders, use the Auto Fibonacci Indicator to identify quick intraday trades. Look for 23.6% and 38.2% levels for scalping opportunities in strong trends, capitalizing on smaller price movements.

3. Swing Trading: In a swing trading context, focus on the 50% and 61.8% levels for potential reversal points and plan to hold trades for longer durations to maximize profit potential.

By integrating the Auto Fibonacci Indicator into your MT5 trading, you can enhance your trading strategy with precise levels that offer entry, exit, and risk management tactics, ultimately improving your chances of success in the market.