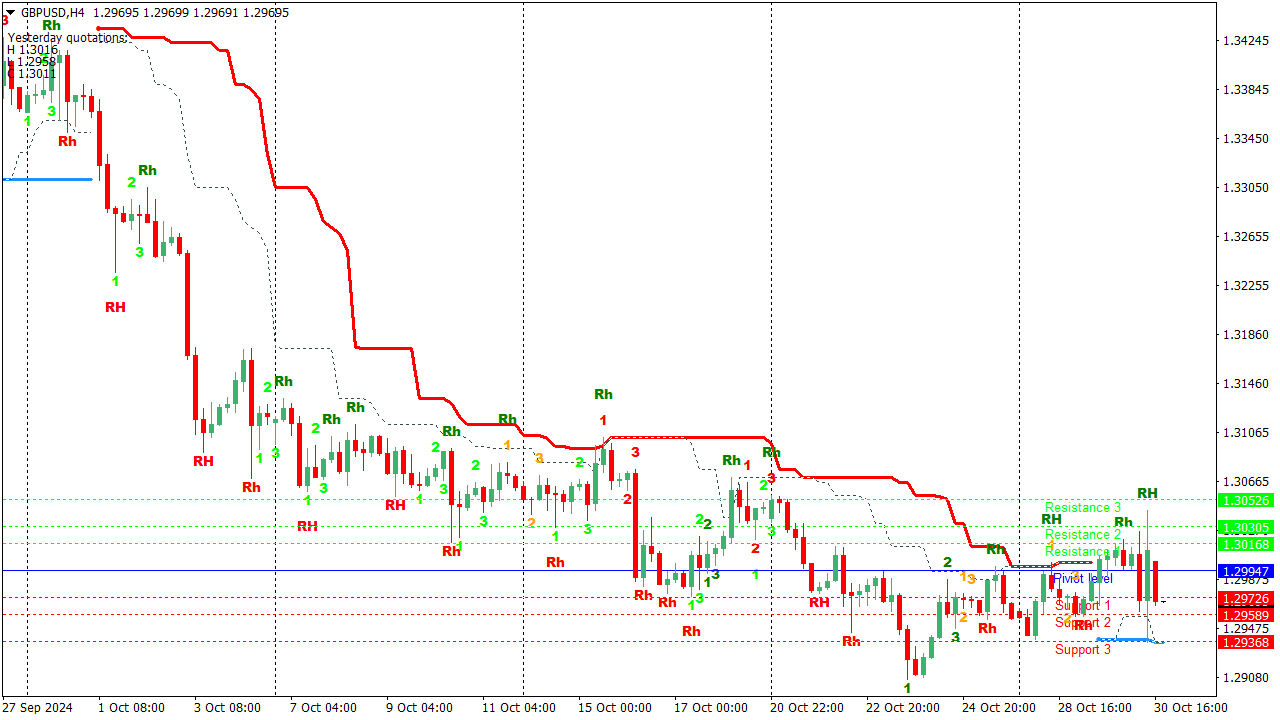

Ross Hook (RH) Price Action Trading System

↪️ DOWNLOAD IT BELOW ⏬

Price action trading is a trading strategy that relies on analyzing historical price movements to make trading decisions, rather than using technical indicators or fundamental analysis. Traders focus on the price movements, chart patterns, and market structure to identify trends and potential reversal points, often utilizing candlestick patterns and support and resistance levels. This approach emphasizes understanding buyer and seller behavior, allowing traders to capitalize on market dynamics and execute trades based on the anticipated future movements of price.

Here’s a list of some common price action strategies:

1. Support and Resistance Breakouts: Identify key support and resistance levels on the chart. A long entry can be triggered when the price breaks above resistance with strong volume, while a short entry can be taken when it breaks below support. Look for a retest of the breakout point for confirmation.

2. Pin Bar Reversal: A pin bar is a candlestick pattern that indicates potential reversals. A long position can be entered when a pin bar forms at a significant support level, while a short position may be signaled by a pin bar at resistance. Confirmation from subsequent candles improves reliability.

3. Engulfing Patterns: Bullish engulfing patterns suggest a potential uptrend reversal, while bearish engulfing patterns indicate a possible downtrend reversal. Enter long after a bullish engulfing pattern appears at support and vice versa for short entries.

4. Inside Bar Strategy: This strategy involves waiting for a day (inside bar) where price moves within the range of the previous day. Enter long if the price breaks above the inside bar high or short if it breaks below the low. It's critical to confirm with volume.

5. Trendline Breaks: Draw trendlines connecting recent highs or lows to establish the trend. A break above a descending trendline can be a bullish signal (enter long), while a break below an ascending trendline may indicate a bearish signal (enter short).

6. Moving Average Crossovers: Using a simple moving average (SMA) or exponential moving average (EMA), a crossover can signal possible entries. A buy signal can be generated when a shorter-term moving average crosses above a longer-term moving average, while a sell signal occurs when the opposite happens.

7. Fibonacci Retracement Levels: Price often retraces to key Fibonacci levels before continuing in the direction of the trend. Long entries can be made at the 38.2% or 61.8% retracement levels in an uptrend, while shorts can be entered at the same levels in a downtrend.

8. Relative Strength Index (RSI) Divergence: When the price makes a new high or low but the RSI does not, it can indicate a reversal. Enter a long position on bullish divergence or a short position on bearish divergence for potential reversals.

9. Breakout and Pullback: After a significant breakout, wait for a pullback to the breakout level for an entry point. If the price holds at the breakout level, it confirms the new trend direction.

10. Combining Multiple Signals: Enhance entry decisions by looking for confluence among different strategies, such as price action at support/resistance levels in conjunction with candlestick patterns or indicators.

Each of these strategies requires practice and an understanding of risk management principles. Set stop-loss orders to manage risk effectively and define profit targets based on previous price actions or risk-reward ratios. Always backtest these strategies to ensure they align with your trading style and goals.