Scalping Trading System

↪️ DOWNLOAD IT BELOW ⤵️

Scalping trading is a short-term trading strategy that involves making numerous trades throughout the day to capitalize on small price movements in the market. Traders, known as scalpers, typically hold positions for seconds to minutes and aim to exploit inefficiencies or small fluctuations in stock, forex, or cryptocurrency prices. This strategy requires quick decision-making, efficient execution, and a solid understanding of market dynamics, often supported by advanced charting tools and high-frequency trading platforms. Scalping can be high-risk and demands disciplined risk management due to its reliance on volume and speed rather than long-term trends.

Here’s a collection of scalping strategies with entry points:

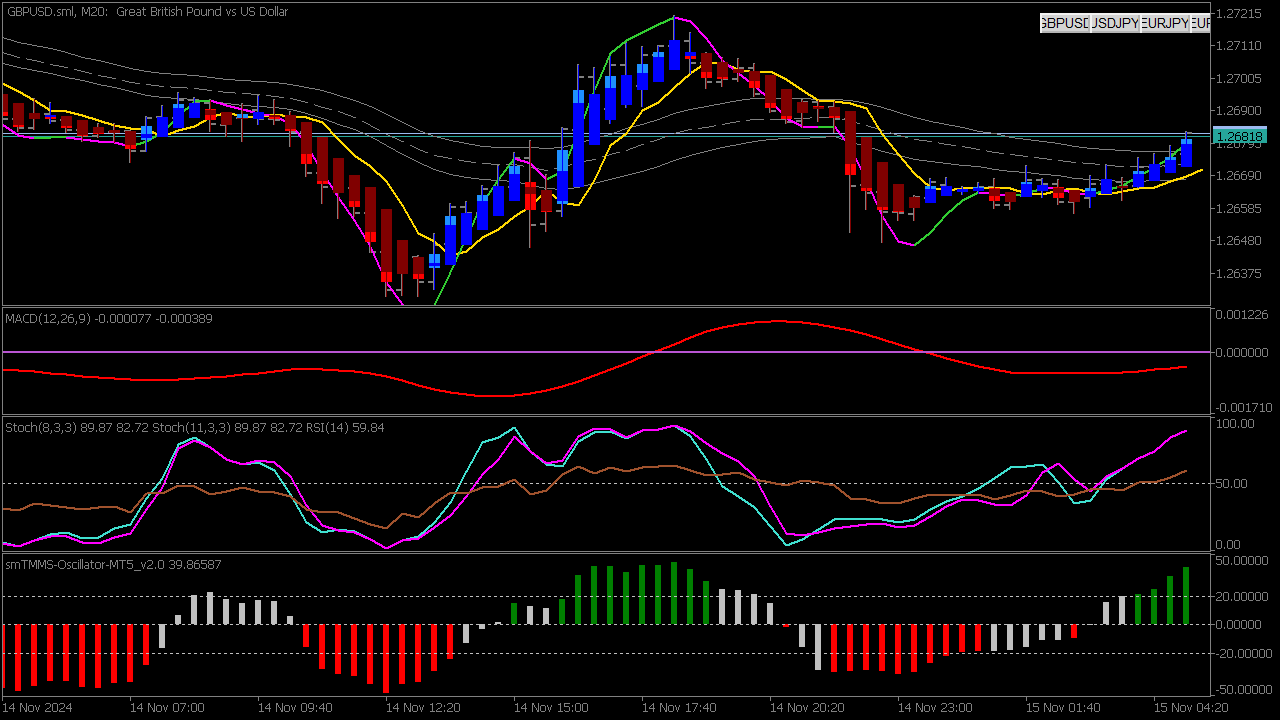

1. Moving Average Crossovers: Enter trades when a short-term moving average crosses above a long-term moving average, signaling a potential upward trend (and vice versa for sell signals).

2. Bollinger Bands: Buy when the price touches the lower band and sell when it touches the upper band. Look for price rejections as confirmation.

3. RSI Overbought/Oversold Levels: Enter a buy position when RSI dips below 30 and then crosses back above, indicating a potential reversal. Sell when RSI exceeds 70.

4. Support and Resistance: Identify key support and resistance levels; buy near support and sell near resistance, confirming with price action.

5. Volume Spikes: Look for unexpected increases in volume as an entry signal, possibly indicating strong momentum. Enter in the direction of the volume spike.

6. Breakout Trading: Enter trades when the price breaks above a resistance level or below a support level, confirming with high volume.

7. Pullback Strategy: After a strong trend, enter on a pullback to a Fibonacci retracement level of 38.2% or 61.8%, looking for buys in uptrends and sells in downtrends.

8. Candlestick Patterns: Use patterns like pin bars, engulfing candles, or hammers at key levels for entry confirmation.

9. MACD Divergence: Look for divergence between price and the MACD indicator; enter when the MACD line crosses above the signal line in uptrends.

10. Scalping with News: Trade around major news events by entering positions shortly before or after the news release, taking advantage of volatility.

11. Heikin-Ashi Charts: These smoothed candles can help identify trends more clearly; enter trades when you see consecutive bullish or bearish candles.

12. Grid Trading: Set buy and sell orders at predefined intervals, capturing profits as price oscillates.

13. Stochastic Oscillator: Buy when the %K line crosses above the %D line below a certain level, indicating oversold conditions, and sell above overbought conditions.

14. Order Flow Trading: Analyze order book data and enter trades based on large buy or sell orders that suggest market direction.

Each strategy should be backtested and applied with strict risk management techniques to enhance profitability in scalping.