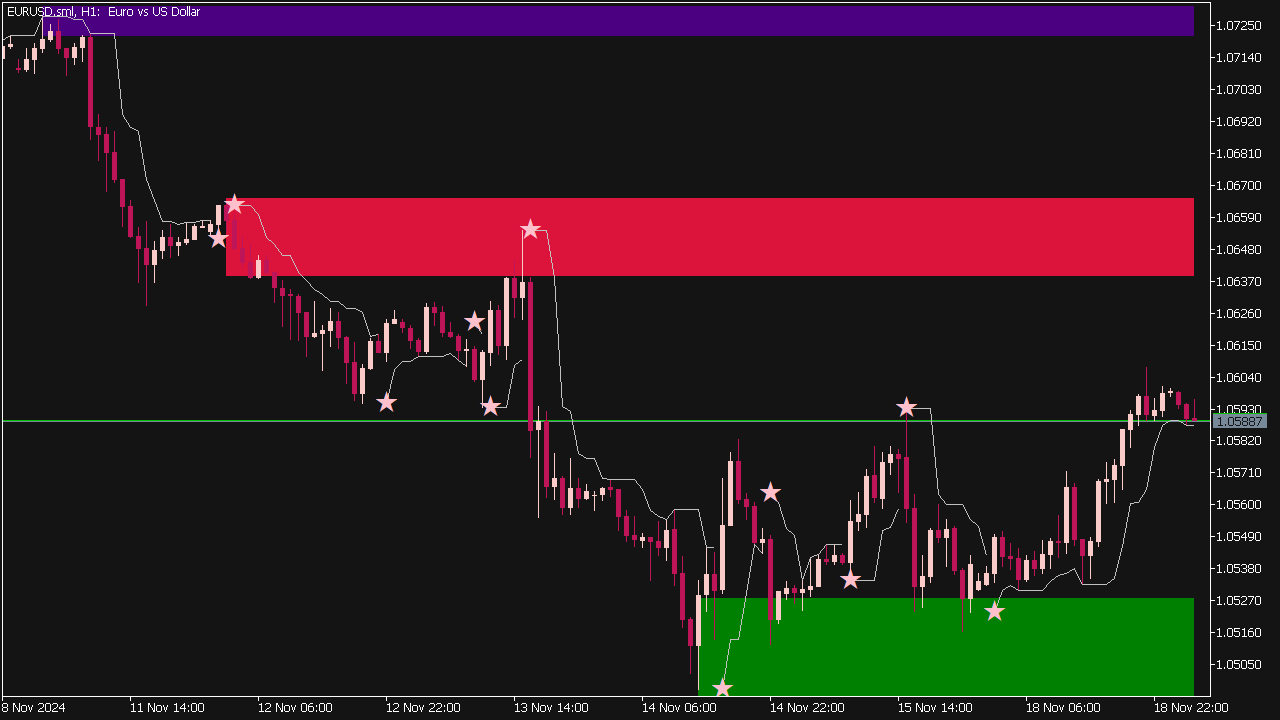

Star Breakout Trading System

↪️ DOWNLOAD IT BELOW ⤵️

A breakout trading strategy involves entering a position when the price moves beyond a defined support or resistance level with increased volume, indicating a potential continuation of the trend. Traders typically identify key levels using technical analysis tools like trendlines, moving averages, or chart patterns. Once the price breaks out, traders can take a long position for upward breakouts or a short position for downward breakouts, often setting stop-loss orders just beyond the breakout level to manage risk. It's important to confirm breakouts with increased volume and to watch for potential false breakouts.

Here are some effective breakout trading strategies:

1. Defining Key Levels: Before executing breakout trades, it's crucial to identify key support and resistance levels. These levels act as barriers where price typically reverses. Traders can use horizontal lines or Fibonacci retracements to mark these levels on their charts. When the price breaks through these levels with high volume, it indicates that there is strong momentum either to the upside or downside.

2. Candlestick Patterns: Certain candlestick formations can signal potential breakouts. For instance, a bullish engulfing pattern near a support level can suggest a breakout to the upside, whereas a bearish engulfing pattern near resistance may indicate a downward breakout. Traders should look for confirmation through subsequent candles to mitigate the risk of false breakouts.

3. Volume Confirmation: Volume is a critical aspect of breakout trading. A breakout that is accompanied by increased trading volume is generally considered more reliable. MT5 offers volume indicators which help traders assess whether there is sufficient interest backing the breakout. A volume spike can affirm that the breakout is likely to sustain its momentum.

4. Time Frames and Market Conditions: Different time frames can yield different signals for breakouts. Day traders might prefer shorter time frames like 5-minute or 15-minute charts for quick entries, whereas swing traders may focus on daily or 4-hour charts. Always consider the broader market conditions; volatile market conditions can provide better opportunities for breakouts but may also introduce higher risk.

5. Using Indicators: Incorporating technical indicators such as the Moving Average Convergence Divergence (MACD) or Bollinger Bands can enhance breakout strategies. For example, a MACD crossover can indicate the momentum direction shortly before a breakout occurs. Bollinger Bands can help identify squeezes, where price volatility is low, often preceding a breakout.

6. Setting Stop Losses: Proper risk management is essential in breakout trading. Traders should place stop-loss orders just below the breakout level in a bullish scenario or above the level in a bearish scenario. This ensures that losses are minimized if the breakout fails and the price reverses.

7. Profit Targets: Setting profit targets is key to managing successful trades. Traders can use recent highs or lows as benchmarks, or apply a risk-reward ratio, such as targeting at least twice the amount risked on the trade. This disciplined approach helps in maximizing potential gains while protecting capital.

8. Backtesting Strategies: MT5 has robust backtesting capabilities. Traders should backtest their breakout strategies using historical data to determine their effectiveness and tweak parameters based on the results. This process can aid in finding the optimal trade settings and improving overall strategy performance.

9. Breakout from Chart Patterns: Recognizing chart patterns like triangles, flags, and head-and-shoulders can also provide breakout trade opportunities. When these patterns complete, they often result in substantial price movements. Look for clear breakout confirmations alongside volume before acting on these signals.

10. Be Wary of False Breakouts: One of the biggest challenges in breakout trading is the occurrence of false breakouts, where price moves beyond a level temporarily but then reverses. Employing multi-confirmation strategies, such as waiting for a close above resistance with volume, can reduce the likelihood of entering false signals.

Implementing these strategies can enhance your chances of successfully trading breakouts in MT5. Remember, patience and discipline are key, as not every breakout leads to profit. It’s essential to practice these strategies in a demo environment before applying them in live trading.