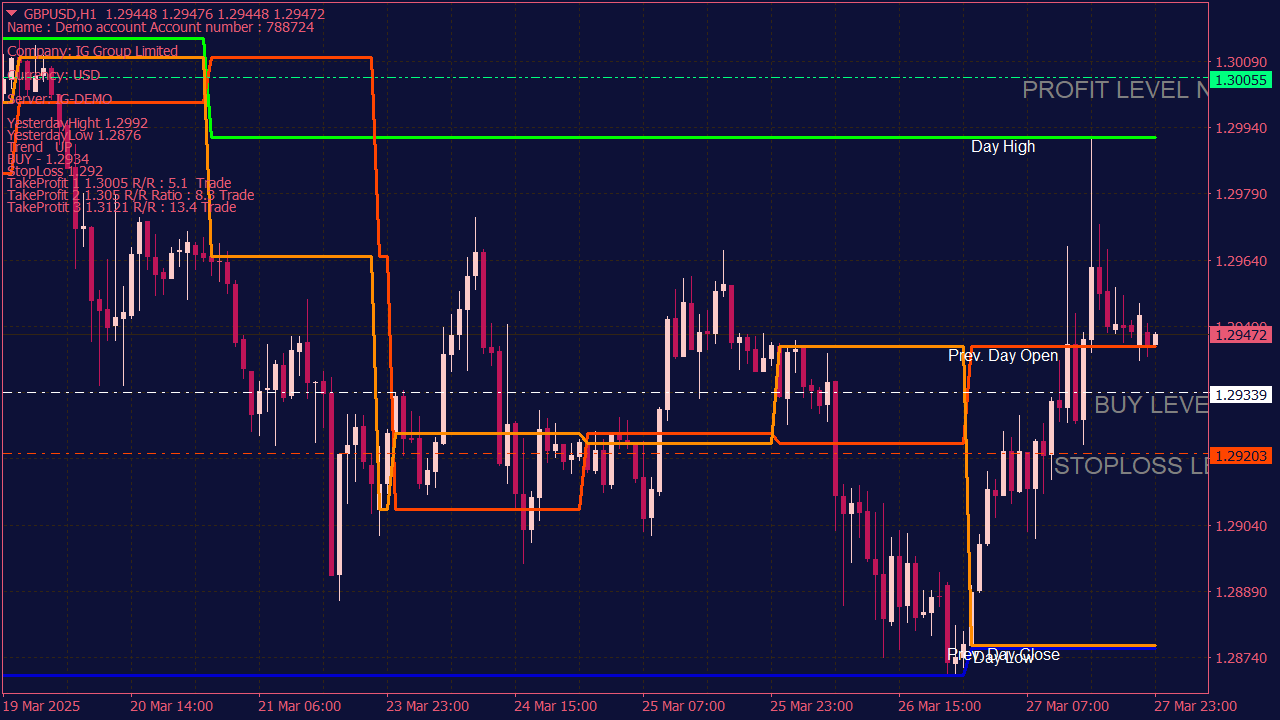

SL and TP Levels Indicator

The Buy and Sell Levels with Targets indicator automatically marks optimal entry points for long and short trades, along with clearly defined target levels. Based on price structure, trend direction, and volatility, it helps traders plan precise entries and exits for improved risk management and profit potential. Suitable for all timeframes and trading styles.